March 27, 20210000050863December 252021Q1FALSE79,77877,6454,0384,0624,0384,0620.6950.660.6950.6600000508632020-12-272021-03-27xbrli:shares00000508632021-03-27iso4217:USD00000508632019-12-292020-03-280000050863us-gaap:RetainedEarningsMember2020-12-272021-03-27iso4217:USDxbrli:shares00000508632020-12-2600000508632019-12-2800000508632020-03-280000050863srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2020-12-260000050863srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-260000050863us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2020-12-260000050863srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2020-12-260000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-272021-03-270000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2020-12-272021-03-270000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2021-03-270000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-270000050863us-gaap:RetainedEarningsMember2021-03-270000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2019-12-280000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-280000050863us-gaap:RetainedEarningsMember2019-12-280000050863us-gaap:RetainedEarningsMember2019-12-292020-03-280000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-292020-03-280000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2019-12-292020-03-280000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2020-03-280000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-280000050863us-gaap:RetainedEarningsMember2020-03-280000050863intc:DCGPlatformMember2020-12-272021-03-270000050863intc:DCGPlatformMember2019-12-292020-03-280000050863intc:OtherProductOrServiceMemberintc:DataCenterGroupMember2020-12-272021-03-270000050863intc:OtherProductOrServiceMemberintc:DataCenterGroupMember2019-12-292020-03-280000050863intc:DataCenterGroupMember2020-12-272021-03-270000050863intc:DataCenterGroupMember2019-12-292020-03-280000050863intc:InternetOfThingsGroupMember2020-12-272021-03-270000050863intc:InternetOfThingsGroupMember2019-12-292020-03-280000050863intc:MobileyeMember2020-12-272021-03-270000050863intc:MobileyeMember2019-12-292020-03-280000050863intc:InternetofThingsMember2020-12-272021-03-270000050863intc:InternetofThingsMember2019-12-292020-03-280000050863intc:NonVolatileMemorySolutionsGroupMember2020-12-272021-03-270000050863intc:NonVolatileMemorySolutionsGroupMember2019-12-292020-03-280000050863intc:ProgrammableSolutionsGroupMember2020-12-272021-03-270000050863intc:ProgrammableSolutionsGroupMember2019-12-292020-03-280000050863intc:ClientComputingGroupMemberintc:PlatformMember2020-12-272021-03-270000050863intc:ClientComputingGroupMemberintc:PlatformMember2019-12-292020-03-280000050863intc:ClientComputingGroupMemberintc:OtherProductOrServiceMember2020-12-272021-03-270000050863intc:ClientComputingGroupMemberintc:OtherProductOrServiceMember2019-12-292020-03-280000050863intc:ClientComputingGroupMember2020-12-272021-03-270000050863intc:ClientComputingGroupMember2019-12-292020-03-280000050863us-gaap:AllOtherSegmentsMember2020-12-272021-03-270000050863us-gaap:AllOtherSegmentsMember2019-12-292020-03-280000050863intc:IOTGPlatformMember2020-12-272021-03-270000050863intc:IOTGPlatformMember2019-12-292020-03-280000050863intc:DesktopPlatformMember2020-12-272021-03-270000050863intc:DesktopPlatformMember2019-12-292020-03-280000050863intc:NotebookPlatformMember2020-12-272021-03-270000050863intc:NotebookPlatformMember2019-12-292020-03-280000050863intc:OtherPlatformMember2020-12-272021-03-270000050863intc:OtherPlatformMember2019-12-292020-03-280000050863intc:PlatformMember2020-12-272021-03-270000050863intc:PlatformMember2019-12-292020-03-280000050863intc:OtherProductOrServiceMember2020-12-272021-03-270000050863intc:OtherProductOrServiceMember2019-12-292020-03-280000050863intc:PrepaidSupplyAgreementsMember2020-12-260000050863intc:PrepaidSupplyAgreementsMember2020-12-272021-03-270000050863intc:PrepaidSupplyAgreementsMember2021-03-270000050863us-gaap:DebtSecuritiesMember2020-12-272021-03-270000050863us-gaap:DebtSecuritiesMember2019-12-292020-03-280000050863intc:BejingUnisocTechnologyLtdMember2020-12-272021-03-270000050863intc:BejingUnisocTechnologyLtdMember2021-03-270000050863intc:BejingUnisocTechnologyLtdMember2020-12-2600000508632020-10-192020-10-190000050863srt:ScenarioForecastMember2021-11-012021-11-010000050863srt:ScenarioForecastMember2025-03-012025-03-310000050863srt:ScenarioForecastMember2021-03-282021-10-310000050863us-gaap:RevolvingCreditFacilityMemberintc:VariableRateRevolvingCreditFacilityMember2021-03-270000050863us-gaap:CommercialPaperMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CashEquivalentsMemberus-gaap:FixedIncomeSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMemberus-gaap:FixedIncomeSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:FixedIncomeSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CashEquivalentsMemberus-gaap:FixedIncomeSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMemberus-gaap:FixedIncomeSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:FixedIncomeSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CashEquivalentsMemberintc:GovernmentDebtSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:FairValueInputsLevel2Memberintc:GovernmentDebtSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMemberintc:GovernmentDebtSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberintc:GovernmentDebtSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CashEquivalentsMemberintc:GovernmentDebtSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:FairValueInputsLevel2Memberintc:GovernmentDebtSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMemberintc:GovernmentDebtSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberintc:GovernmentDebtSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CashEquivalentsMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:FairValueInputsLevel2Member2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CashEquivalentsMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:FairValueInputsLevel2Member2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMember2020-12-260000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2021-03-270000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-03-270000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2021-03-270000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2021-03-270000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2020-12-260000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-260000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2020-12-260000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2020-12-260000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeSecuritiesMember2021-03-270000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-03-270000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FixedIncomeSecuritiesMember2021-03-270000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMember2021-03-270000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeSecuritiesMember2020-12-260000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-260000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FixedIncomeSecuritiesMember2020-12-260000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMember2020-12-260000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberintc:GovernmentDebtSecuritiesMember2021-03-270000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberintc:GovernmentDebtSecuritiesMember2021-03-270000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberintc:GovernmentDebtSecuritiesMember2021-03-270000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberintc:GovernmentDebtSecuritiesMember2021-03-270000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberintc:GovernmentDebtSecuritiesMember2020-12-260000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberintc:GovernmentDebtSecuritiesMember2020-12-260000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberintc:GovernmentDebtSecuritiesMember2020-12-260000050863us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberintc:GovernmentDebtSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FixedIncomeSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FixedIncomeSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberintc:GovernmentDebtSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberintc:GovernmentDebtSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberintc:GovernmentDebtSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberintc:GovernmentDebtSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberintc:GovernmentDebtSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberintc:GovernmentDebtSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberintc:GovernmentDebtSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberintc:GovernmentDebtSecuritiesMember2020-12-260000050863us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-03-270000050863us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-03-270000050863us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-03-270000050863us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2021-03-270000050863us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-260000050863us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-12-260000050863us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-260000050863us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:OtherLongTermInvestmentsMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueInputsLevel2Member2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:OtherLongTermInvestmentsMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:OtherLongTermInvestmentsMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:OtherLongTermInvestmentsMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueInputsLevel2Member2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:OtherLongTermInvestmentsMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:OtherLongTermInvestmentsMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeSecuritiesMemberus-gaap:OtherLongTermInvestmentsMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueInputsLevel2Member2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FixedIncomeSecuritiesMemberus-gaap:OtherLongTermInvestmentsMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:OtherLongTermInvestmentsMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeSecuritiesMemberus-gaap:OtherLongTermInvestmentsMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueInputsLevel2Member2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FixedIncomeSecuritiesMemberus-gaap:OtherLongTermInvestmentsMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:OtherLongTermInvestmentsMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherLongTermInvestmentsMemberintc:GovernmentDebtSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberintc:GovernmentDebtSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:OtherLongTermInvestmentsMemberintc:GovernmentDebtSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberintc:GovernmentDebtSecuritiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherLongTermInvestmentsMemberintc:GovernmentDebtSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberintc:GovernmentDebtSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:OtherLongTermInvestmentsMemberintc:GovernmentDebtSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberintc:GovernmentDebtSecuritiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherNoncurrentAssetsMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueInputsLevel2Member2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:OtherNoncurrentAssetsMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentAssetsMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherNoncurrentAssetsMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueInputsLevel2Member2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:OtherNoncurrentAssetsMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentAssetsMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherCurrentLiabilitiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherCurrentLiabilitiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:OtherCurrentLiabilitiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherCurrentLiabilitiesMember2021-03-270000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherCurrentLiabilitiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherCurrentLiabilitiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:OtherCurrentLiabilitiesMember2020-12-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherCurrentLiabilitiesMember2020-12-260000050863us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-03-270000050863us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-03-270000050863us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-03-270000050863us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2021-03-270000050863us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-260000050863us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-12-260000050863us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-260000050863us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-260000050863us-gaap:FairValueMeasurementsNonrecurringMember2021-03-270000050863us-gaap:FairValueMeasurementsNonrecurringMember2020-12-260000050863us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2020-12-260000050863us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2020-12-260000050863us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2020-12-260000050863us-gaap:AccumulatedTranslationAdjustmentMember2020-12-260000050863us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2020-12-272021-03-270000050863us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2020-12-272021-03-270000050863us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2020-12-272021-03-270000050863us-gaap:AccumulatedTranslationAdjustmentMember2020-12-272021-03-270000050863us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2021-03-270000050863us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2021-03-270000050863us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2021-03-270000050863us-gaap:AccumulatedTranslationAdjustmentMember2021-03-270000050863us-gaap:ForeignExchangeContractMember2021-03-270000050863us-gaap:ForeignExchangeContractMember2020-12-260000050863us-gaap:InterestRateContractMember2021-03-270000050863us-gaap:InterestRateContractMember2020-12-260000050863us-gaap:OtherContractMember2021-03-270000050863us-gaap:OtherContractMember2020-12-260000050863us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMemberus-gaap:OtherAssetsMember2021-03-270000050863us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMemberus-gaap:OtherLiabilitiesMember2021-03-270000050863us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMemberus-gaap:OtherAssetsMember2020-12-260000050863us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMemberus-gaap:OtherLiabilitiesMember2020-12-260000050863us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherAssetsMemberus-gaap:InterestRateContractMember2021-03-270000050863us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMemberus-gaap:OtherLiabilitiesMember2021-03-270000050863us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherAssetsMemberus-gaap:InterestRateContractMember2020-12-260000050863us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMemberus-gaap:OtherLiabilitiesMember2020-12-260000050863us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherAssetsMember2021-03-270000050863us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherLiabilitiesMember2021-03-270000050863us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherAssetsMember2020-12-260000050863us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherLiabilitiesMember2020-12-260000050863us-gaap:ForeignExchangeContractMemberus-gaap:OtherAssetsMemberus-gaap:NondesignatedMember2021-03-270000050863us-gaap:ForeignExchangeContractMemberus-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMember2021-03-270000050863us-gaap:ForeignExchangeContractMemberus-gaap:OtherAssetsMemberus-gaap:NondesignatedMember2020-12-260000050863us-gaap:ForeignExchangeContractMemberus-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMember2020-12-260000050863us-gaap:OtherAssetsMemberus-gaap:InterestRateContractMemberus-gaap:NondesignatedMember2021-03-270000050863us-gaap:InterestRateContractMemberus-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMember2021-03-270000050863us-gaap:OtherAssetsMemberus-gaap:InterestRateContractMemberus-gaap:NondesignatedMember2020-12-260000050863us-gaap:InterestRateContractMemberus-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMember2020-12-260000050863us-gaap:OtherAssetsMemberus-gaap:OtherContractMemberus-gaap:NondesignatedMember2021-03-270000050863us-gaap:OtherLiabilitiesMemberus-gaap:OtherContractMemberus-gaap:NondesignatedMember2021-03-270000050863us-gaap:OtherAssetsMemberus-gaap:OtherContractMemberus-gaap:NondesignatedMember2020-12-260000050863us-gaap:OtherLiabilitiesMemberus-gaap:OtherContractMemberus-gaap:NondesignatedMember2020-12-260000050863us-gaap:OtherAssetsMemberus-gaap:NondesignatedMember2021-03-270000050863us-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMember2021-03-270000050863us-gaap:OtherAssetsMemberus-gaap:NondesignatedMember2020-12-260000050863us-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMember2020-12-260000050863us-gaap:OtherAssetsMember2021-03-270000050863us-gaap:OtherLiabilitiesMember2021-03-270000050863us-gaap:OtherAssetsMember2020-12-260000050863us-gaap:OtherLiabilitiesMember2020-12-260000050863us-gaap:ForeignExchangeContractMember2020-12-272021-03-270000050863us-gaap:ForeignExchangeContractMember2019-12-292020-03-280000050863us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:FairValueHedgingMember2020-12-272021-03-270000050863us-gaap:InterestRateContractMember2020-12-272021-03-270000050863us-gaap:InterestRateContractMember2019-12-292020-03-280000050863us-gaap:LongTermDebtMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2021-03-270000050863us-gaap:LongTermDebtMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2020-12-260000050863us-gaap:LongTermDebtMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2020-12-272021-03-270000050863us-gaap:LongTermDebtMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2019-12-292020-12-260000050863us-gaap:NondesignatedMember2020-12-272021-03-270000050863us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMember2020-12-272021-03-270000050863us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMember2019-12-292020-03-280000050863us-gaap:InterestRateContractMemberus-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMember2020-12-272021-03-270000050863us-gaap:InterestRateContractMemberus-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMember2019-12-292020-03-280000050863us-gaap:OtherContractMemberus-gaap:NondesignatedMemberintc:VariousMember2020-12-272021-03-270000050863us-gaap:OtherContractMemberus-gaap:NondesignatedMemberintc:VariousMember2019-12-292020-03-280000050863us-gaap:NondesignatedMember2019-12-292020-03-28iso4217:EUR0000050863intc:EcFineMember2009-05-012009-05-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | | | | | | | |

| | ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the quarterly period ended | March 27, 2021 |

Or

| | | | | | | | |

| | ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to |

Commission File Number 000-06217

INTEL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | | 94-1672743 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | |

| 2200 Mission College Boulevard, | Santa Clara, | California | | 95054-1549 |

| (Address of principal executive offices) | | (Zip Code) |

(408) 765-8080

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.001 par value | INTC | Nasdaq Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large Accelerated Filer | | Accelerated filer | | Non-accelerated filer | | Smaller reporting company | Emerging growth company |

☑

| | ¨ | | ¨ | | ☐ | ☐ |

| | | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

As of March 27, 2021, the registrant had outstanding 4,038 million shares of common stock.

Table of Contents

The Organization of Our Quarterly Report on Form 10-Q

The order and presentation of content in our Form 10-Q differs from the traditional SEC Form 10-Q format. Our format is designed to improve readability and better present how we organize and manage our business. See "Form 10-Q Cross-Reference Index" within Other Key Information for a cross-reference index to the traditional SEC Form 10-Q format.

We have defined certain terms and abbreviations used throughout our Form 10-Q in "Key Terms" within the Consolidated Condensed Financial Statements and Supplemental Details.

The preparation of our Consolidated Condensed Financial Statements is in conformity with U.S. GAAP. Our Form 10-Q includes key metrics that we use to measure our business, some of which are non-GAAP measures. See "Non-GAAP Financial Measures" within MD&A for an explanation of these measures and why management uses them and believes they provide investors with useful supplemental information.

| | | | | | | | | | | |

| | | Page |

Forward-Looking Statements | |

| |

A Quarter in Review | |

Consolidated Condensed Financial Statements and Supplemental Details | |

| Consolidated Condensed Statements of Income | |

| Consolidated Condensed Statements of Comprehensive Income | |

| Consolidated Condensed Balance Sheets | |

| Consolidated Condensed Statements of Cash Flows | |

| Consolidated Condensed Statements of Stockholders' Equity | |

| Notes to Consolidated Condensed Financial Statements | |

| Key Terms | |

| | | |

Management's Discussion and Analysis | |

| | |

| | |

| Segment Trends and Results | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Consolidated Results of Operations | |

| Liquidity and Capital Resources | |

| | |

| | |

| Non-GAAP Financial Measures | |

| | | |

Other Key Information | |

| Quantitative and Qualitative Disclosures about Market Risk | |

| Risk Factors | |

| Controls and Procedures | |

| | |

| Issuer Purchases of Equity Securities | |

| Exhibits | |

| Form 10-Q Cross-Reference Index | |

Forward-Looking Statements

This Form 10-Q contains forward-looking statements that involve a number of risks and uncertainties. Words such as "anticipate," "expect," "intend," "plan," "opportunity," "future," "pending," "to be," "believes," "estimated," "continue," "likely," "may," "might," "potentially," "will," "would," "should," "could," “accelerate,” "progress," “goal,” and variations of such words and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to Intel’s strategy; internal and external manufacturing plans, including future internal manufacturing volumes and external foundry usage; manufacturing expansion and investment plans, including Intel’s anticipated Arizona expansion; plans and goals related to Intel’s foundry business, including with respect to future manufacturing capacity; foundry service offerings, including technology and IP offerings; future responses to and effects of COVID-19; projections of our future financial performance and demand; our anticipated growth and trends in our businesses or operations; projected growth and trends in markets relevant to our businesses; business plans; future products and technology and the expected availability and benefits of such products and technology; expected timing and impact of acquisitions, divestitures, and other significant transactions, including statements relating to the pending divestiture of our NAND memory business to SK hynix Inc. (SK hynix), NAND manufacturing and supply arrangements between Intel and SK hynix, and expected additions to held for sale NAND property, plant and equipment; expected completion of restructuring activities; availability, uses, sufficiency, and cost of capital and capital resources, including expected returns to stockholders such as dividends and share repurchases; accounting estimates and judgments regarding reported matters, events and contingencies and our intentions with respect to such matters, events and contingencies, and the actual results thereof; future production capacity and product supply; the future impact of industry component and substrate constraints; the future purchase, use, and availability of products, components and services supplied by third parties, including third-party manufacturing services; tax-related expectations; the future impact of export licensing and trade policies; uncertain events or assumptions; and other characterizations of future events or circumstances are forward-looking statements. Such statements are based on management's expectations as of the date of this filing, unless an earlier date is specified, and involve many risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Such risks and uncertainties include those described throughout this report and our 2020 Form 10-K, particularly the "Risk Factors" sections of such reports, as well as the risks and uncertainties described in our press releases issued on March 23, 2021, which are attached as exhibits to our Form 8-K furnished to the SEC on that date. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Readers are urged to carefully review and consider the various disclosures made in this Form 10-Q and in other documents we file from time to time with the SEC that disclose risks and uncertainties that may affect our business. Unless specifically indicated otherwise, the forward-looking statements in this Form 10-Q do not reflect the potential impact of any divestitures, mergers, acquisitions, or other business combinations that have not been completed as of the date of this filing. In addition, the forward-looking statements in this Form 10-Q are made as of the date of this filing, unless an earlier date is specified, including expectations based on third-party information and projections that management believes to be reputable, and Intel does not undertake, and expressly disclaims any duty, to update such statements, whether as a result of new information, new developments, or otherwise, except to the extent that disclosure may be required by law.

Intel, the Intel logo, Intel Core, Intel Optane and Intel vPro, are trademarks of Intel Corporation or its subsidiaries in the U.S. and/or other countries.

* Other names and brands may be claimed as the property of others.

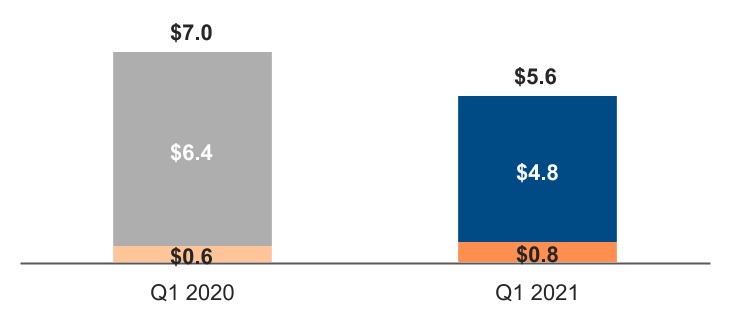

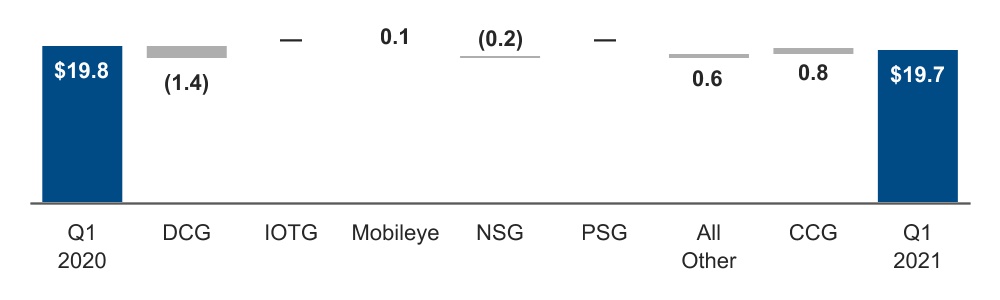

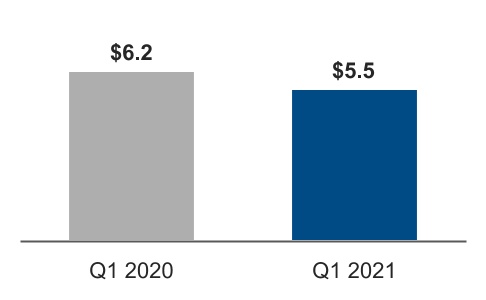

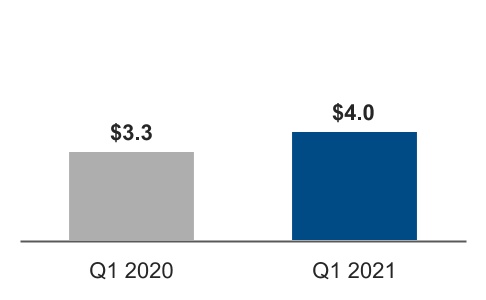

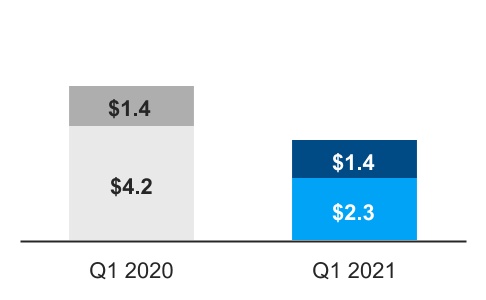

Total revenue of $19.7 billion was down $155 million year over year as DCG declined 20% and CCG grew 8%. Decline in DCG revenue was driven by lower volume due to digestion in the cloud service providers market segment, a decline in the enterprise and government market segment on weaker macroeconomic conditions, and lower ASPs driven by higher SoC volume and weaker core mix. CCG revenue was up, driven by strength in notebook demand, partially offset by an increased mix of consumer and education PCs, which drove lower notebook ASPs. IOTG and Mobileye were both up on higher demand amid recovery from the economic impacts of COVID-19, including recovery in the auto industry from pandemic lows. In the first three months, we generated $5.5 billion of cash flow from operations and returned $3.7 billion to stockholders, including $1.4 billion in dividends and $2.3 billion in buybacks.

| | | | | | | | | | | | | | | | | | | | |

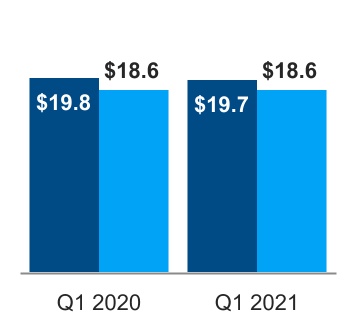

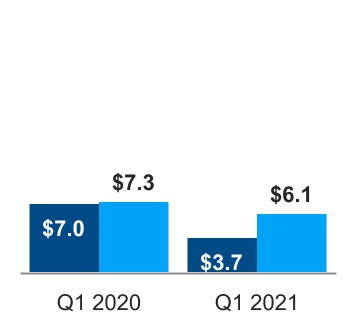

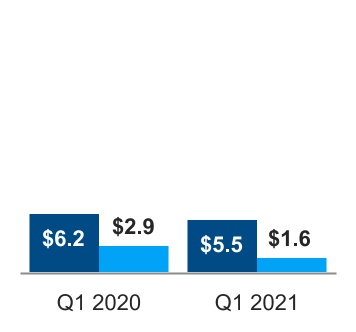

| Revenue | | Operating Income | | Diluted EPS | | Cash Flows |

■ GAAP $B ■ Non-GAAP $B | | ■ GAAP $B ■ Non-GAAP $B | | ■ GAAP ■ Non-GAAP | | ■ Operating Cash Flow $B ■ Free Cash Flow $B |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| $19.7B | | $18.6B | | $3.7B | | $6.1B | | $0.82 | | $1.39 | | $5.5B | | $1.6B |

| GAAP | | non-GAAP1 | | GAAP | | non-GAAP1 | | GAAP | | non-GAAP1 | | GAAP | | non-GAAP1 |

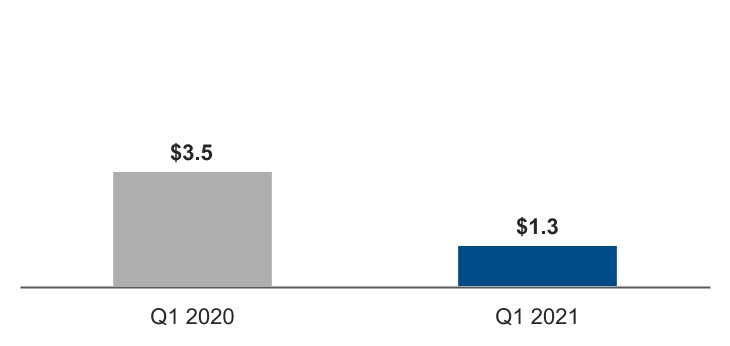

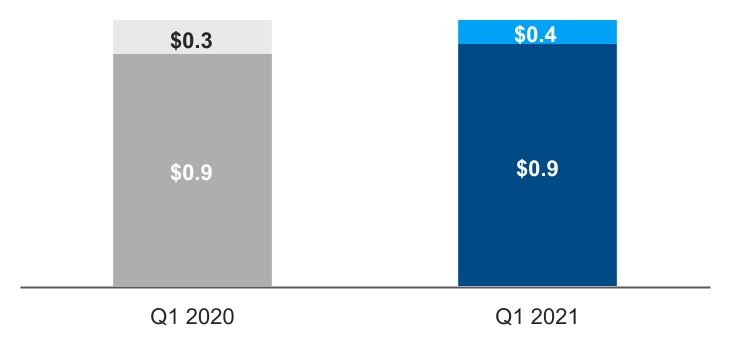

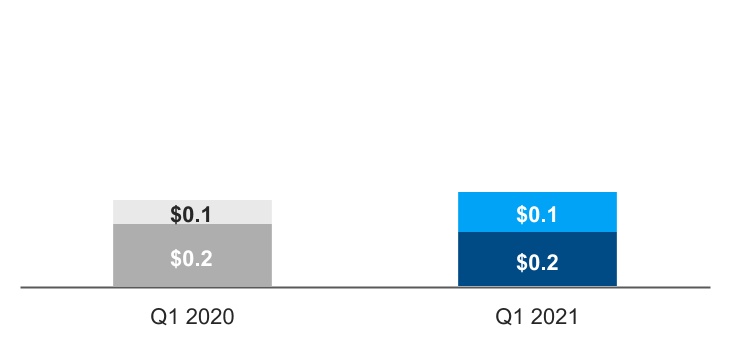

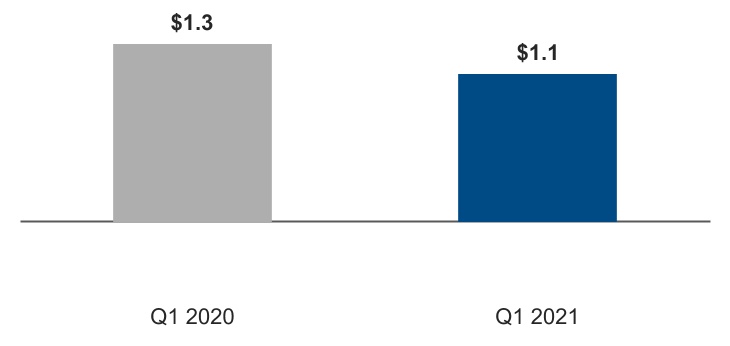

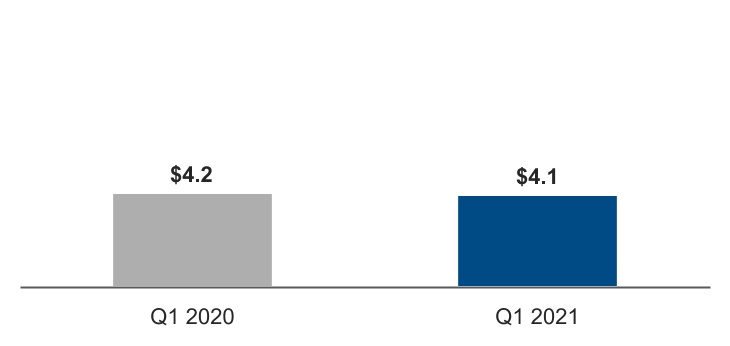

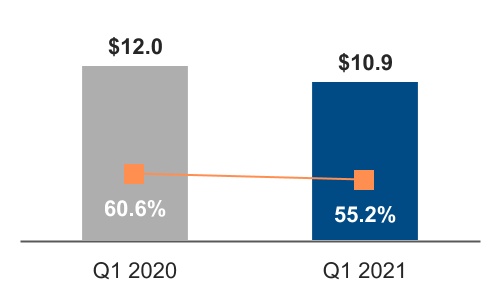

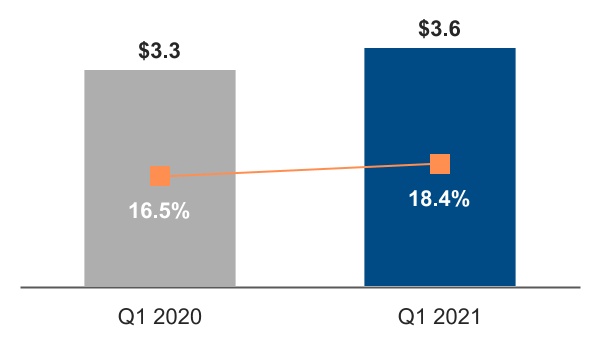

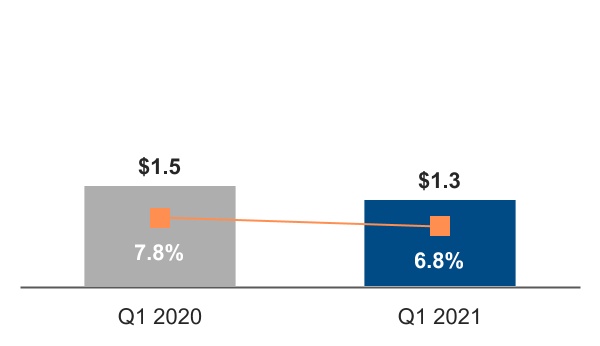

| Revenue down $155M or 1% from Q1 2020 | | Revenue flat from Q1 2020 | | Operating income down $3.3B or 48% from Q1 2020; Q1 2021 operating margin at 19% | | Operating income down $1.3B or 17% from Q1 2020; Q1 2021 operating margin at 33% | | Diluted EPS down $0.49 or 37% from Q1 2020 | | Diluted EPS down $0.02 or 1% from Q1 2020 | | Operating cash flow down $610M or 10% from Q1 2020 | | Free cash flow down $1.3B or 45% from Q1 2020 |

| | | | | | | | | | | | |

Decline in DCG and slight decline in NSG, partially offset by growth in CCG and Corporate revenue of $584 million from a prepaid supply agreement. Non-GAAP results exclude NSG and were flat year over year. | | Corporate charge of $2.2 billion related to the VLSI litigation, lower gross margin from lower platform2 revenue and higher platform unit cost from increased mix in 10nm products, and higher 7nm period charges partially offset by Corporate revenue from a prepaid supply agreement and improved adjacent business performance. Non-GAAP results exclude the Corporate VLSI charge and NSG. | | Lower operating income partially offset by equity investment gains, lower effective tax rate and lower shares. Non-GAAP results incrementally exclude ongoing mark-to-market adjustments and tax impacts of non-GAAP adjustments. | | Lower net income, net of non-cash adjustments including the Corporate VLSI charge, and cash paid to settle a prepaid supply agreement. Free cash flow decreased due to lower operating cash flow and higher capital spending. |

Key Developments

▪On March 23, 2021, our CEO Pat Gelsinger announced our "IDM 2.0" strategy, the next evolution of our IDM model. IDM 2.0 combines three factors. First, we will continue to build the majority of our products in Intel fabs. Second, we expect our use of third-party foundry capacity to grow and to include manufacturing for a range of modular tiles on advanced process technologies. Third, we announced our plans to build a world-class foundry business with Intel Foundry Services, which will combine leading-edge process and packaging technology, committed capacity in the U.S. and Europe, and a world-class IP portfolio for customers, including x86 cores. To accelerate our IDM 2.0 strategy, we announced plans to invest $20.0 billion to build two new fabs in Arizona.

▪We announced the 11th Gen Intel® CoreTM vPro® processors, with performance, discrete-level graphics, and AI acceleration for productivity, collaboration, and content creation for business—meeting the demands of a varied workforce working remotely or in the office. We also launched the 11th Gen Intel® CoreTM S-series desktop processor, known as Rocket Lake-S, designed to transform hardware and software efficiency and increase raw gaming performance.

1 See "Non-GAAP Financial Measures" within MD&A.

2 See "Key Terms" within Consolidated Condensed Financial Statements and Supplemental Details.

| | | | | |

Consolidated Condensed Statements of Income | |

| |

| | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | |

(In Millions, Except Per Share Amounts; Unaudited) | | Mar 27, 2021 | | Mar 28, 2020 | | | | |

| Net revenue | | $ | 19,673 | | | $ | 19,828 | | | | | |

| Cost of sales | | 8,819 | | | 7,812 | | | | | |

| Gross margin | | 10,854 | | | 12,016 | | | | | |

| Research and development | | 3,623 | | | 3,275 | | | | | |

| Marketing, general and administrative | | 1,328 | | | 1,541 | | | | | |

| Restructuring and other charges | | 2,209 | | | 162 | | | | | |

| Operating expenses | | 7,160 | | | 4,978 | | | | | |

| Operating income | | 3,694 | | | 7,038 | | | | | |

| Gains (losses) on equity investments, net | | 368 | | | (111) | | | | | |

| Interest and other, net | | (156) | | | (313) | | | | | |

| Income before taxes | | 3,906 | | | 6,614 | | | | | |

| Provision for taxes | | 545 | | | 953 | | | | | |

| Net income | | $ | 3,361 | | | $ | 5,661 | | | | | |

| Earnings per share—basic | | $ | 0.83 | | | $ | 1.33 | | | | | |

| Earnings per share—diluted | | $ | 0.82 | | | $ | 1.31 | | | | | |

| | | | | | | | |

| Weighted average shares of common stock outstanding: | | | | | | | | |

| Basic | | 4,056 | | | 4,266 | | | | | |

| Diluted | | 4,096 | | | 4,312 | | | | | |

See accompanying notes.

| | | | | | | | | | | |

| Financial Statements | Consolidated Condensed Statements of Income | 3 |

| | | | | |

Consolidated Condensed Statements of Comprehensive Income | |

| |

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

(In Millions; Unaudited) | | Mar 27, 2021 | | Mar 28, 2020 | | | | |

| Net income | | $ | 3,361 | | | $ | 5,661 | | | | | |

| Changes in other comprehensive income, net of tax: | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net unrealized holding gains (losses) on derivatives | | (350) | | | (268) | | | | | |

| Actuarial valuation and other pension benefits (expenses), net | | 13 | | | 12 | | | | | |

| Translation adjustments and other | | (15) | | | (5) | | | | | |

| Other comprehensive income (loss) | | (352) | | | (261) | | | | | |

| Total comprehensive income | | $ | 3,009 | | | $ | 5,400 | | | | | |

See accompanying notes.

| | | | | | | | | | | |

| Financial Statements | Consolidated Condensed Statements of Comprehensive Income | 4 |

| | | | | |

Consolidated Condensed Balance Sheets | |

| |

| | | | | | | | | | | | | | |

(In Millions) | | Mar 27, 2021 | | Dec 26, 2020 |

| | (unaudited) | | |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 5,192 | | | $ | 5,865 | |

| Short-term investments | | 2,417 | | | 2,292 | |

| Trading assets | | 14,788 | | | 15,738 | |

| Accounts receivable | | 7,208 | | | 6,782 | |

| Inventories | | 8,487 | | | 8,427 | |

| Assets held for sale | | 5,557 | | | 5,400 | |

| Other current assets | | 2,124 | | | 2,745 | |

| Total current assets | | 45,773 | | | 47,249 | |

| | | | |

| Property, plant and equipment, net of accumulated depreciation of $79,778 ($77,645 as of December 26, 2020) | | 57,330 | | | 56,584 | |

| Equity investments | | 5,404 | | | 5,152 | |

| Other long-term investments | | 1,409 | | | 2,192 | |

| Goodwill | | 26,971 | | | 26,971 | |

| Identified intangible assets, net | | 8,408 | | | 9,026 | |

| Other long-term assets | | 5,327 | | | 5,917 | |

| Total assets | | $ | 150,622 | | | $ | 153,091 | |

| | | | |

| Liabilities and stockholders’ equity | | | | |

| Current liabilities: | | | | |

| Short-term debt | | $ | 2,647 | | | $ | 2,504 | |

| Accounts payable | | 5,434 | | | 5,581 | |

| Accrued compensation and benefits | | 2,757 | | | 3,999 | |

| | | | |

| | | | |

| Other accrued liabilities | | 13,313 | | | 12,670 | |

| Total current liabilities | | 24,151 | | | 24,754 | |

| | | | |

| Debt | | 33,237 | | | 33,897 | |

| Contract liabilities | | 90 | | | 1,367 | |

| Income taxes payable | | 4,605 | | | 4,578 | |

| Deferred income taxes | | 3,410 | | | 3,843 | |

| Other long-term liabilities | | 5,322 | | | 3,614 | |

| Contingencies (Note 13) | | | | |

| | | | |

| Stockholders’ equity: | | | | |

| | | | |

| Common stock and capital in excess of par value, 4,038 issued and outstanding (4,062 issued and outstanding as of December 26, 2020) | | 26,272 | | | 25,556 | |

| Accumulated other comprehensive income (loss) | | (1,103) | | | (751) | |

| Retained earnings | | 54,638 | | | 56,233 | |

| Total stockholders’ equity | | 79,807 | | | 81,038 | |

| Total liabilities and stockholders’ equity | | $ | 150,622 | | | $ | 153,091 | |

See accompanying notes.

| | | | | | | | | | | |

| Financial Statements | Consolidated Condensed Balance Sheets | 5 |

| | | | | |

Consolidated Condensed Statements of Cash Flows | |

| |

| | | | | | | | | | | | | | |

| | Three Months Ended |

(In Millions; Unaudited) | | Mar 27, 2021 | | Mar 28, 2020 |

| | | | |

| Cash and cash equivalents, beginning of period | | $ | 5,865 | | | $ | 4,194 | |

| Cash flows provided by (used for) operating activities: | | | | |

| Net income | | 3,361 | | | 5,661 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation | | 2,454 | | | 2,623 | |

| Share-based compensation | | 425 | | | 449 | |

| | | | |

| Restructuring and other charges | | 2,209 | | | 162 | |

| Amortization of intangibles | | 448 | | | 427 | |

| (Gains) losses on equity investments, net | | (299) | | | 134 | |

| | | | |

| | | | |

| | | | |

| Changes in assets and liabilities: | | | | |

| Accounts receivable | | (426) | | | (796) | |

| Inventories | | 180 | | | (548) | |

| Accounts payable | | 303 | | | 117 | |

| Accrued compensation and benefits | | (1,283) | | | (1,605) | |

| Prepaid supply agreements | | (1,566) | | | (87) | |

| Income taxes | | 383 | | | 753 | |

| Other assets and liabilities | | (641) | | | (1,132) | |

| Total adjustments | | 2,187 | | | 497 | |

| Net cash provided by operating activities | | 5,548 | | | 6,158 | |

| Cash flows provided by (used for) investing activities: | | | | |

| Additions to property, plant and equipment | | (3,972) | | | (3,268) | |

| Additions to held for sale NAND property, plant and equipment | | (416) | | | — | |

| | | | |

| Purchases of available-for-sale debt investments | | (593) | | | (513) | |

| | | | |

| Maturities and sales of available-for-sale debt investments | | 1,232 | | | 625 | |

| Purchases of trading assets | | (5,981) | | | (3,897) | |

| Maturities and sales of trading assets | | 6,777 | | | 3,660 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Other investing | | 406 | | | (343) | |

| Net cash used for investing activities | | (2,547) | | | (3,736) | |

| Cash flows provided by (used for) financing activities: | | | | |

| | | | |

| | | | |

| | | | |

| Issuance of long-term debt, net of issuance costs | | — | | | 10,247 | |

| Repayment of debt and debt conversion | | — | | | (1,075) | |

| Proceeds from sales of common stock through employee equity incentive plans | | 565 | | | 503 | |

| Repurchase of common stock | | (2,301) | | | (4,229) | |

| | | | |

| | | | |

| Payment of dividends to stockholders | | (1,411) | | | (1,408) | |

| | | | |

| | | | |

| | | | |

| Other financing | | (527) | | | 726 | |

| Net cash provided by (used for) financing activities | | (3,674) | | | 4,764 | |

| | | | |

| Net increase (decrease) in cash and cash equivalents | | (673) | | | 7,186 | |

| Cash and cash equivalents, end of period | | $ | 5,192 | | | $ | 11,380 | |

| | | | |

| Supplemental disclosures of noncash investing activities and cash flow information: | | | | |

| Acquisition of property, plant, and equipment included in accounts payable and accrued liabilities | | $ | 2,472 | | | $ | 2,294 | |

| | | | |

| | | | |

| Cash paid during the period for: | | | | |

| Interest, net of capitalized interest | | $ | 161 | | | $ | 67 | |

| Income taxes, net of refunds | | $ | 172 | | | $ | 211 | |

See accompanying notes.

| | | | | | | | | | | |

| Financial Statements | Consolidated Condensed Statements of Cash Flows | 6 |

| | | | | |

Consolidated Condensed Statements of Stockholders' Equity | |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock and Capital in Excess of Par Value | | Accumulated Other Comprehensive Income (Loss) | | Retained Earnings1 | | Total |

| (In Millions, Except Per Share Amounts; Unaudited) | | Shares | | Amount | | | |

| Three Months Ended | | | | | | | | | | |

| | | | | | | | | | |

| Balance as of December 26, 2020 | | 4,062 | | | $ | 25,556 | | | $ | (751) | | | $ | 56,268 | | | $ | 81,073 | |

| Net income | | — | | | — | | | — | | | 3,361 | | | 3,361 | |

| Other comprehensive income (loss) | | — | | | — | | | (352) | | | — | | | (352) | |

| Employee equity incentive plans and other | | 17 | | | 565 | | | — | | | — | | | 565 | |

| Share-based compensation | | — | | | 425 | | | — | | | — | | | 425 | |

| Temporary equity reduction | | — | | | — | | | — | | | — | | | — | |

| Convertible debt | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | |

| Repurchase of common stock | | (40) | | | (249) | | | — | | | (2,166) | | | (2,415) | |

| | | | | | | | | | |

| Restricted stock unit withholdings | | (1) | | | (25) | | | — | | | (4) | | | (29) | |

| Cash dividends declared ($0.695 per share) | | — | | | — | | | — | | | (2,821) | | | (2,821) | |

| Balance as of March 27, 2021 | | 4,038 | | | $ | 26,272 | | | $ | (1,103) | | | $ | 54,638 | | | $ | 79,807 | |

| | | | | | | | | | |

| Balance as of December 28, 2019 | | 4,290 | | | $ | 25,261 | | | $ | (1,280) | | | $ | 53,523 | | | $ | 77,504 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Net income | | — | | | — | | | — | | | 5,661 | | | 5,661 | |

| Other comprehensive income (loss) | | — | | | — | | | (261) | | | — | | | (261) | |

| Employee equity incentive plans and other | | 17 | | | 620 | | | — | | | — | | | 620 | |

| Share-based compensation | | — | | | 449 | | | — | | | — | | | 449 | |

| Temporary equity reduction | | — | | | 155 | | | — | | | — | | | 155 | |

| Convertible debt | | — | | | (750) | | | — | | | — | | | (750) | |

| | | | | | | | | | |

| Repurchase of common stock | | (71) | | | (420) | | | — | | | (3,689) | | | (4,109) | |

| Restricted stock unit withholdings | | (2) | | | (64) | | | — | | | (32) | | | (96) | |

| Cash dividends declared ($0.66 per share) | | — | | | — | | | — | | | (2,819) | | | (2,819) | |

| | | | | | | | | | |

| Balance as of March 28, 2020 | | 4,234 | | | $ | 25,251 | | | $ | (1,541) | | | $ | 52,644 | | | $ | 76,354 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

1.The retained earnings balance as of December 26, 2020 includes an opening balance adjustment made as a result of the adoption of a new accounting standard in 2021.

See accompanying notes.

| | | | | | | | | | | |

| Financial Statements | Consolidated Condensed Statements of Stockholders' Equity | 7 |

| | | | | |

Notes to Consolidated Condensed Financial Statements | |

| |

| | | | | |

| Note 1 : | Basis of Presentation |

We prepared our interim Consolidated Condensed Financial Statements that accompany these notes in conformity with U.S. GAAP, consistent in all material respects with those applied in our 2020 Form 10-K.

We have made estimates and judgments affecting the amounts reported in our Consolidated Condensed Financial Statements and the accompanying notes. The actual results that we experience may differ materially from our estimates. The interim financial information is unaudited, and reflects all normal adjustments that are, in our opinion, necessary to provide a fair statement of results for the interim periods presented. This report should be read in conjunction with the Consolidated Financial Statements in our 2020 Form 10-K where we include additional information about our policies and the methods and assumptions used in our estimates.

| | | | | |

| Note 2 : | Operating Segments |

We manage our business through the following operating segments:

▪DCG

▪IOTG

▪Mobileye

▪NSG

▪PSG

▪CCG

We derive a substantial majority of our revenue from platform products, which are our principal products and considered as one product class. We offer platform products that incorporate various components and technologies, including a microprocessor and chipset, a stand-alone SoC, or a multichip package. Platform products are used in various form factors across our DCG, IOTG, and CCG operating segments. Our non-platform, or adjacent products, can be combined with platform products to form comprehensive platform solutions to meet customer needs.

DCG and CCG are our reportable operating segments. IOTG, Mobileye, NSG, and PSG do not meet the quantitative thresholds to qualify as reportable operating segments; however, we have elected to disclose the results of these non-reportable operating segments. Our Internet of Things portfolio, presented as Internet of Things, is comprised of IOTG and Mobileye operating segments. In 2021, our DCG operating segment includes the results of our Intel® OptaneTM memory business, and our NSG operating segment is composed of our NAND memory business. Refer to "Note 8: Acquisitions and Divestitures" within Notes to Consolidated Condensed Financial Statements for further information on the pending divestiture of our NAND memory business.

We have an “all other” category that includes revenue, expenses, and charges such as:

▪results of operations from non-reportable segments not otherwise presented;

▪historical results of operations from divested businesses;

▪results of operations of start-up businesses that support our initiatives, including our foundry business;

▪amounts included within restructuring and other charges;

▪a portion of employee benefits, compensation, and other expenses not allocated to the operating segments; and

▪acquisition-related costs, including amortization and any impairment of acquisition-related intangibles and goodwill.

The CODM, who is our CEO, does not evaluate operating segments using discrete asset information. Operating segments do not record inter-segment revenue. We do not allocate gains and losses from equity investments, interest and other income, or taxes to operating segments. Although the CODM uses operating income to evaluate the segments, operating costs included in one segment may benefit other segments. The accounting policies for segment reporting are the same as for Intel as a whole.

| | | | | | | | | | | |

| Financial Statements | Notes to Financial Statements | 8 |

Net revenue and operating income (loss) for each period were as follows:

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

(In Millions) | | Mar 27, 2021 | | Mar 28, 2020 | | | | |

| Net revenue: | | | | | | | | |

| Data Center Group | | | | | | | | |

| Platform | | $ | 4,811 | | | $ | 6,427 | | | | | |

| Adjacent | | 753 | | | 566 | | | | | |

| | 5,564 | | | 6,993 | | | | | |

| Internet of Things | | | | | | | | |

| IOTG | | 914 | | | 883 | | | | | |

| Mobileye | | 377 | | | 254 | | | | | |

| | 1,291 | | | 1,137 | | | | | |

| | | | | | | | |

| | | | | | | | |

| Non-Volatile Memory Solutions Group | | 1,107 | | | 1,338 | | | | | |

| Programmable Solutions Group | | 486 | | | 519 | | | | | |

| Client Computing Group | | | | | | | | |

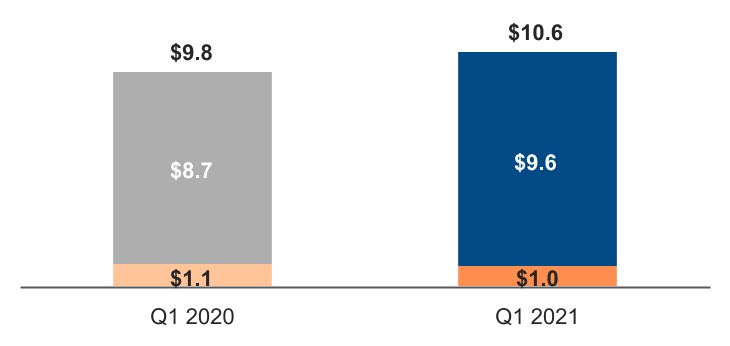

| Platform | | 9,617 | | | 8,712 | | | | | |

| Adjacent | | 988 | | | 1,063 | | | | | |

| | 10,605 | | | 9,775 | | | | | |

| | | | | | | | |

| All other | | 620 | | | 66 | | | | | |

| Total net revenue | | $ | 19,673 | | | $ | 19,828 | | | | | |

| | | | | | | | |

| Operating income (loss): | | | | | | | | |

| Data Center Group | | $ | 1,273 | | | $ | 3,492 | | | | | |

| | | | | | | | |

| Internet of Things | | | | | | | | |

| IOTG | | 212 | | | 243 | | | | | |

| Mobileye | | 147 | | | 88 | | | | | |

| | 359 | | | 331 | | | | | |

| | | | | | | | |

| Non-Volatile Memory Solutions Group | | 171 | | | (66) | | | | | |

| Programmable Solutions Group | | 88 | | | 97 | | | | | |

| Client Computing Group | | 4,120 | | | 4,225 | | | | | |

| All other | | (2,317) | | | (1,041) | | | | | |

| Total operating income | | $ | 3,694 | | | $ | 7,038 | | | | | |

Disaggregated net revenue for each period was as follows:

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

(In Millions) | | Mar 27, 2021 | | Mar 28, 2020 | | | | |

| Platform revenue | | | | | | | | |

| DCG platform | | $ | 4,811 | | | $ | 6,427 | | | | | |

| IOTG platform | | 840 | | | 795 | | | | | |

| CCG desktop platform | | 2,644 | | | 2,840 | | | | | |

| CCG notebook platform | | 6,959 | | | 5,857 | | | | | |

CCG other platform1 | | 14 | | | 15 | | | | | |

| | 15,268 | | | 15,934 | | | | | |

| | | | | | | | |

Adjacent revenue2 | | 4,405 | | | 3,894 | | | | | |

| Total revenue | | $ | 19,673 | | | $ | 19,828 | | | | | |

1 Includes our tablet and service provider revenue.

2 Includes all of our non-platform products for DCG, IOTG, and CCG such as modem, Ethernet, and silicon photonics, as well as Mobileye, NSG, and PSG products, as well as revenue included in our "all other" category.

| | | | | | | | | | | |

| Financial Statements | Notes to Financial Statements | 9 |

| | | | | |

| Note 3 : | Earnings Per Share |

We computed basic earnings per share of common stock based on the weighted average number of shares of common stock outstanding during the period. We computed diluted earnings per share of common stock based on the weighted average number of shares of common stock outstanding plus potentially dilutive shares of common stock outstanding during the period.

| | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | |

| (In Millions, Except Per Share Amounts) | | Mar 27, 2021 | | Mar 28, 2020 | | | | |

| Net income available to common stockholders | | $ | 3,361 | | | $ | 5,661 | | | | | |

| Weighted average shares of common stock outstanding—basic | | 4,056 | | | 4,266 | | | | | |

| Dilutive effect of employee equity incentive plans | | 40 | | | 46 | | | | | |

| | | | | | | | |

| Weighted average shares of common stock outstanding—diluted | | 4,096 | | | 4,312 | | | | | |

Earnings per share—basic

| | $ | 0.83 | | | $ | 1.33 | | | | | |

Earnings per share—diluted

| | $ | 0.82 | | | $ | 1.31 | | | | | |

Potentially dilutive shares of common stock from employee equity incentive plans are determined by applying the treasury stock method to the assumed exercise of outstanding stock options, the assumed vesting of outstanding RSUs, and the assumed issuance of common stock under the stock purchase plan.

Securities which would have been anti-dilutive are insignificant and are excluded from the computation of diluted earnings per share in all periods presented.

| | | | | |

| Note 4 : | Contract Liabilities |

Contract liabilities consist of prepayments received from customers on long-term prepaid supply agreements toward future product delivery and other revenue deferrals from regular ongoing business activity. Contract liabilities were $396 million as of March 27, 2021 ($1.9 billion as of December 26, 2020).

The following table shows the changes in contract liability balances relating to long-term prepaid supply agreements during the first three months of 2021:

| | | | | | | | |

| (In Millions) | | |

| Prepaid supply agreements balance as of December 26, 2020 | | $ | 1,625 | |

| | |

| Concession payment | | (950) | |

| Prepaids utilized | | (616) | |

| Prepaid supply agreements balance as of March 27, 2021 | | $ | 59 | |

During the first quarter of 2021, we settled an agreement with our largest prepaid customer whose prepayment balance made up $1.6 billion of our contract liability balance as of December 26, 2020. We returned $950 million to the customer and recognized $584 million in revenue during the quarter for having completed performance of the prepaid supply agreement. The prepaid supply agreement is excluded from the NAND memory business and is recorded as Corporate revenue in the "all other" category presented in "Note 2: Operating Segments" within Notes to Consolidated Condensed Financial Statements.

| | | | | |

| Note 5 : | Other Financial Statement Details |

Inventories

| | | | | | | | | | | | | | |

(In Millions) | | Mar 27, 2021 | | Dec 26, 2020 |

Raw materials | | $ | 926 | | | $ | 908 | |

Work in process | | 5,758 | | | 5,693 | |

Finished goods | | 1,803 | | | 1,826 | |

| Total inventories | | $ | 8,487 | | | $ | 8,427 | |

| | | | | | | | | | | |

| Financial Statements | Notes to Financial Statements | 10 |

Interest and Other, Net

| | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | |

(In Millions) | | Mar 27, 2021 | | Mar 28, 2020 | | | | |

Interest income | | $ | 37 | | | $ | 93 | | | | | |

Interest expense | | (190) | | | (135) | | | | | |

Other, net | | (3) | | | (271) | | | | | |

| Total interest and other, net | | $ | (156) | | | $ | (313) | | | | | |

Interest expense in the preceding table is net of $97 million of interest capitalized in the first three months of 2021 ($83 million in the first three months of 2020).

| | | | | |

| Note 6 : | Restructuring and Other Charges |

A restructuring program, which is ongoing, was approved in the first quarter of 2020 to further align our workforce with our continuing investments in the business and to execute the planned divestiture of Home Gateway Platform, a division of CCG. These actions are expected to be substantially completed in 2021.

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | |

| (In Millions) | | Mar 27, 2021 | | Mar 28, 2020 | | | | | |

| Employee severance and benefit arrangements | | $ | 6 | | | $ | 105 | | | | | | |

| | | | | | | | | |

| Litigation charges and other | | 2,203 | | | 57 | | | | | | |

| Total restructuring and other charges | | $ | 2,209 | | | $ | 162 | | | | | | |

Litigation charges and other includes a charge of $2.2 billion in the first three months of 2021 related to the VLSI litigation, which is recorded as a Corporate charge in the "all other" category presented in "Note 2: Operating Segments" within Notes to Consolidated Condensed Financial Statements. Refer to "Note 13: Contingencies" within Notes to Consolidated Condensed Financial Statements for further information on legal proceedings related to the VLSI litigation.

Debt Investments

Trading Assets

Net losses recorded for trading assets still held at the reporting date were $372 million in the first three months of 2021 ($231 million of net losses in the first three months of 2020). Net gains on the related derivatives were $366 million in the first three months of 2021 ($100 million of net gains in the first three months of 2020).

Available-for-Sale Debt Investments

Available-for-sale investments include corporate debt, government debt, and financial institution instruments. Government debt includes instruments such as non-U.S. government bonds and U.S. agency securities. Financial institution instruments include instruments issued or managed by financial institutions in various forms, such as commercial paper, fixed- and floating-rate bonds, money market fund deposits, and time deposits. As of March 27, 2021 and December 26, 2020, substantially all time deposits were issued by institutions outside the U.S. The adjusted cost of our available-for-sale investments was $7.0 billion as of March 27, 2021 and $7.8 billion as of December 26, 2020. The adjusted cost of our available-for-sale investments approximated the fair value for these periods.

The fair value of available-for-sale debt investments, by contractual maturity, as of March 27, 2021, was as follows:

| | | | | | | | |

(In Millions) | | Fair Value |

Due in 1 year or less | | $ | 3,596 | |

Due in 1–2 years | | 341 | |

Due in 2–5 years | | 1,068 | |

Due after 5 years | | — | |

Instruments not due at a single maturity date | | 2,130 | |

| Total | | $ | 7,135 | |

| | | | | | | | | | | |

| Financial Statements | Notes to Financial Statements | 11 |

Equity Investments

| | | | | | | | | | | | | | |

(In Millions) | | Mar 27, 2021 | | Dec 26, 2020 |

Marketable equity securities | | $ | 1,523 | | | $ | 1,830 | |

Non-marketable equity securities | | 3,864 | | | 3,304 | |

Equity method investments | | 17 | | | 18 | |

| Total | | $ | 5,404 | | | $ | 5,152 | |

The components of gains (losses) on equity investments, net for each period were as follows:

| | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | | |

(In Millions) | | Mar 27, 2021 | | Mar 28, 2020 | | | | |

Ongoing mark-to-market adjustments on marketable equity securities | | $ | (291) | | | $ | (103) | | | | | |

Observable price adjustments on non-marketable equity securities | | 551 | | | 79 | | | | | |

Impairment charges | | (38) | | | (143) | | | | | |

| Sale of equity investments and other¹ | | 146 | | | 56 | | | | | |

| Total gains (losses) on equity investments, net | | $ | 368 | | | $ | (111) | | | | | |

1 Sale of equity investments and other includes realized gains (losses) on sales of non-marketable equity investments, our share of equity method investees' gains (losses) and distributions, and initial fair value adjustments recorded upon a security becoming marketable.

Gains and losses for our marketable and non-marketable equity securities for each period were as follows:

| | | | | | | | | | | | | | | |

| | Three Months Ended | |

(In Millions) | | Mar 27, 2021 | | Mar 28, 2020 | |

Net gains (losses) recognized during the period on equity securities | | $ | 311 | | | $ | (140) | | |

| Less: Net (gains) losses recognized during the period on equity securities sold during the period | | (85) | | | (7) | | |

| Unrealized gains (losses) recognized during the reporting period on equity securities still held at the reporting date | | $ | 226 | | | $ | (147) | | |

Beijing Unisoc Technology Ltd.

We account for our interest in Beijing Unisoc Technology Ltd. (Unisoc) as a non-marketable equity security. During the first three months of 2021, we recognized $471 million in observable price adjustments in our investment in Unisoc and as of March 27, 2021 the net book value of the investment is $1.1 billion ($658 million as of December 26, 2020).

| | | | | |

| Note 8 : | Acquisitions and Divestitures |

Divestitures

NAND Memory Business

On October 19, 2020, we signed an agreement with SK hynix Inc. (SK hynix) to divest our NAND memory business, including our NAND memory fabrication facility in Dalian, China and certain related equipment and tangible assets (the Fab Assets), our NAND SSD business (the NAND SSD Business), and our NAND memory technology and manufacturing business (the NAND OpCo Business). Our Intel Optane memory business is expressly excluded from the transaction. The transaction will occur over two closings for total consideration of $9.0 billion in cash, of which $7.0 billion will be received upon initial closing, not to occur prior to November 1, 2021, and the remaining $2.0 billion will be received no earlier than March 2025. The consummations of the first closing and the second closing are subject to customary conditions, including the receipt of certain governmental approvals.

At the first closing, Intel will sell to SK hynix the Fab Assets and the NAND SSD Business, and SK hynix will assume from Intel certain liabilities related to the Fab Assets and the NAND SSD Business. In connection with the first closing, we and certain affiliates of SK hynix will also enter into a NAND wafer manufacturing and sale agreement pursuant to which we will manufacture and sell to SK hynix NAND memory wafers to be manufactured using the Fab Assets in Dalian, China, until the second closing.

We will transfer certain employees, IP, and other assets related to the NAND OpCo Business to separately created, wholly owned subsidiaries of Intel at the first closing. The equity interest of these wholly owned subsidiaries will transfer to SK hynix at the second closing. We have concluded based on the terms of the transaction agreements that the subsidiaries will be variable interest entities for which we are not the primary beneficiary, and accordingly will deconsolidate at the first closing.

| | | | | | | | | | | |

| Financial Statements | Notes to Financial Statements | 12 |

The carrying amounts of the major classes of NAND assets held for sale included the following:

| | | | | | | | | | | | | | |

| (In Millions) | | Mar 27, 2021 | | Dec 26, 2020 |

| Inventories | | $ | 723 | | | $ | 962 | |

| Property, plant and equipment, net | | 4,759 | | | 4,363 | |

| Total assets held for sale | | $ | 5,482 | | | $ | 5,325 | |

We ceased recording depreciation on property, plant and equipment as of the date the assets triggered held for sale accounting. Total capital purchases of approximately $1.8 billion expected in 2021 prior to the first closing will be classified as assets held for sale in the Consolidated Condensed Balance Sheets and within additions to held for sale NAND property, plant and equipment on the Consolidated Condensed Statements of Cash Flows.

In March 2021, we entered into a $5.0 billion variable-rate revolving credit facility which, if drawn, is expected to be used for general corporate purposes. The revolving credit facility matures in March 2026 and had no borrowings outstanding as of March 27, 2021.

We have an ongoing authorization from our Board of Directors to borrow up to $10.0 billion under our commercial paper program.