LETTER FROM YOUR CEO To our stockholders, customers, partners, and employees: Advancing Our Vision and Strategy Intel stands at a pivotal juncture in a world where insatiable demand for processing power is being driven by Al and the convergence of ubiquitous compute, connectivity, infrastructure, and sensing. We see a profound opportunity to push the boundaries of what is possible, to create solutions for the world's most significant challenges, and to improve the lives of everyone on the planet. Intel's mission to create a globally-diversified, resilient, and sustainable supply chain for semiconductors — the most critical and strategic resource of the 21st century — is central to our ambitions. Access to exceptionally engineered and relentlessly innovative chips will be the determining factor in the next phase of innovation for virtually every industry. To usher in this new era and enable our customers to harness this opportunity, Intel is investing in technology and manufacturing leadership as we open our manufacturing network to the world, bring "Al Everywhere," and relentlessly pursue Moore's Law. This is part of our effort to build a stronger Intel and includes the February launch of Intel Foundry, a first-of-its-kind systems foundry for the Al era that comprises our Technology Development, Global Manufacturing and Supply Chain, and foundry customer service and ecosystem operations. Moreover, the establishment of a foundry-like relationship between Intel Foundry and Intel Products, our product business units, will drive greater transparency, accountability, and cost optimization. Making Significant Progress on Our Transformation 2023 marked a year of across-the-board progress on our IDM 2.0 strategy and transformation priorities. We executed on our plan to re-establish process leadership, expanded our capacity and foundry plans, enhanced product execution, and began to realize our vision to bring Al Everywhere. Despite entering the year navigating significant macroeconomic and industry headwinds, the focus on our strategy and on operational and financial discipline enabled us to deliver on our goals. We know there is more work to do, but I'm proud of the team for delivering on what we said we would in 2023, which will enable us to take advantage of the opportunities ahead. Re-establishing Process and Product Leadership We remain on track to re-establish Intel's process technology leadership by delivering on our goal of five nodes in four years (5N4Y), which will be completed by the end of 2024. Intel 3 and Intel 4 are manufacturing-ready and ramping. We are excited to break into the Angstrom era with Intel 20A, set to launch this year, and Intel 18A, on track for manufacturing readiness in the second half of Pat Gelsinger, Chief Executive Officer, Director, and Principal Executive Officer 2024, marking the completion of 5N4Y and returning Intel to process leadership. In February, we unveiled our roadmap beyond 5N4Y with the addition of Intel 14A to Intel's leading-edge node plan, in addition to several specialized node evolutions. Our product roadmap also continues to advance. In the datacenter, we launched Xeon Gen 5 ahead of schedule. Sierra Forest is poised for launch in the first half of 2024, followed shortly by Granite Rapids, which will position Intel to regain share in the data center. Additionally, Clearwater Forest, our first Intel 18A part for servers, is already in the fab. Our Meteor Lake product on Intel 4 is ramping rapidly with 40 million units expected in 2024 and Arrow Lake, our lead Intel 20A vehicle, is slated for launch this year. Our first Intel 18A client platform, Panther Lake, is now in fab as well. Together, we expect to ship well over 100 million Al PCs in 2024 and 2025. Building the First Systems Foundry for the Al Era We are advancing our goal of becoming the world's second- largest foundry by 2030 as part of our broader mission to create a resilient and sustainable global supply chain for semiconductors. At our inaugural Intel Foundry Direct Connect event, in February, we unveiled the new brand and market positioning of Intel Foundry, the world's first systems foundry for the Al era. While still early in our foundry journey, we are seeing significant traction. We began 2023 with a commitment from one Intel 18A foundry customer and ended the year with four. We also achieved five advanced packaging wins, a testament to the advantages of Intel Foundry.

!

"# !

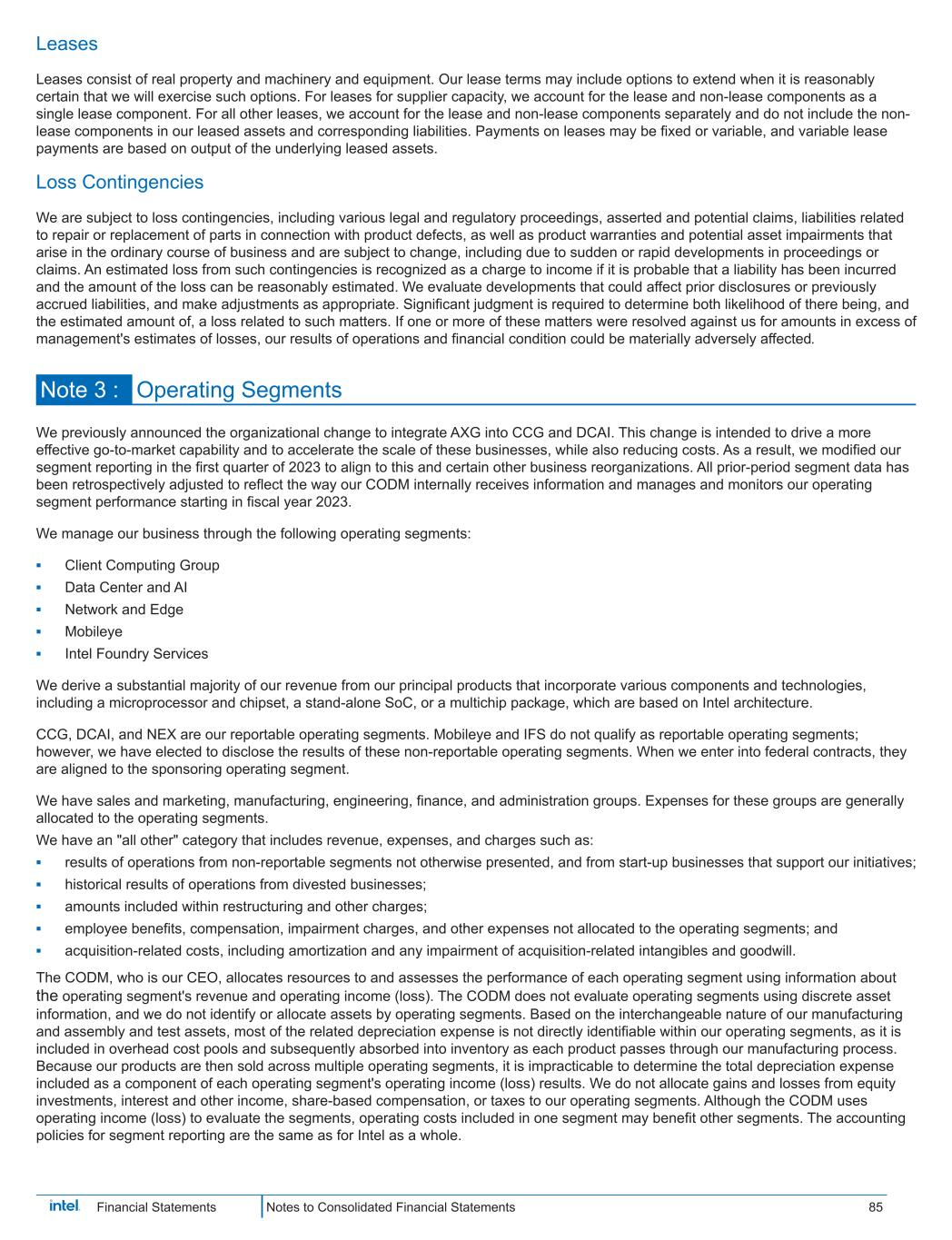

$

$

%

&

' (

)

* +

%

, ,

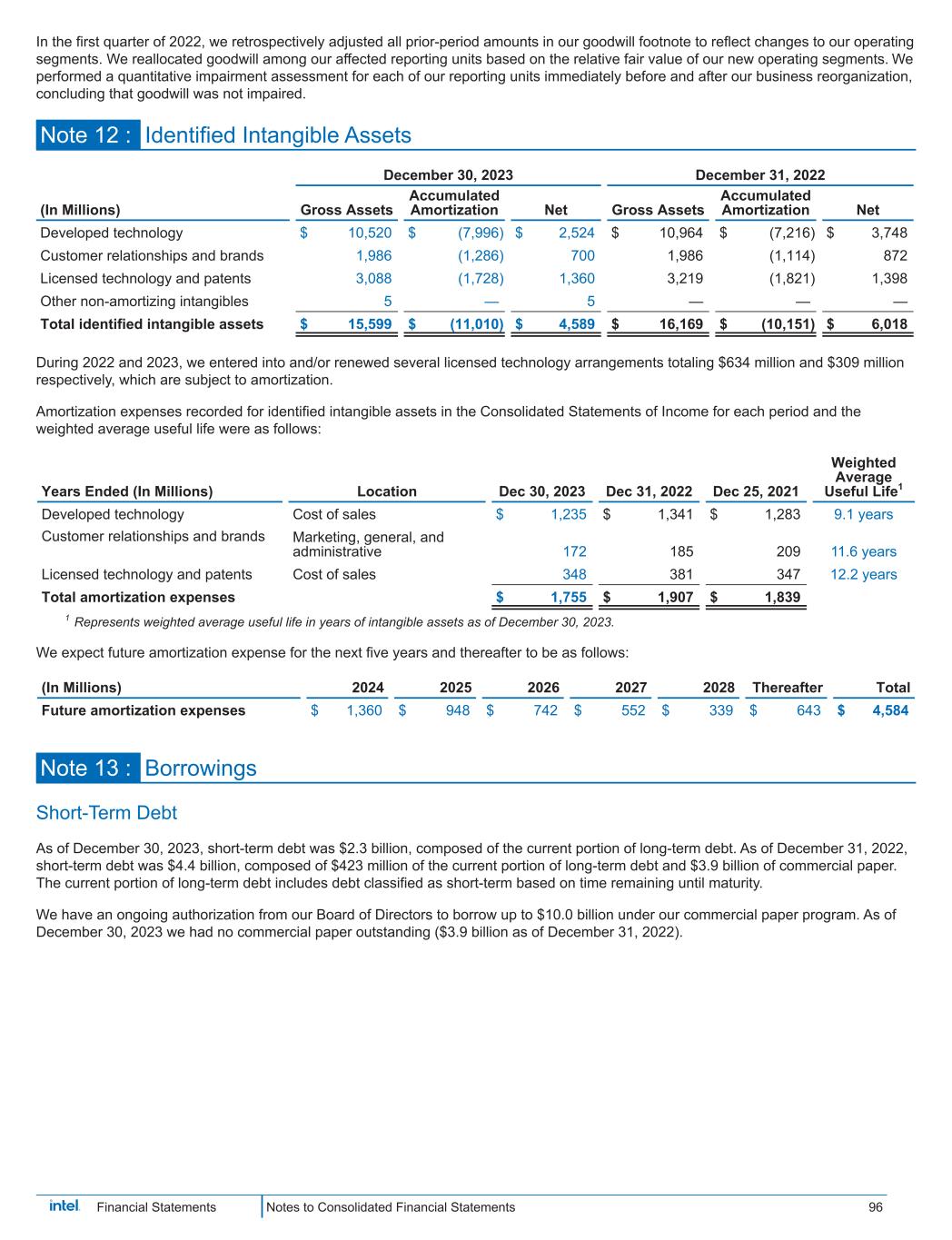

&

% -

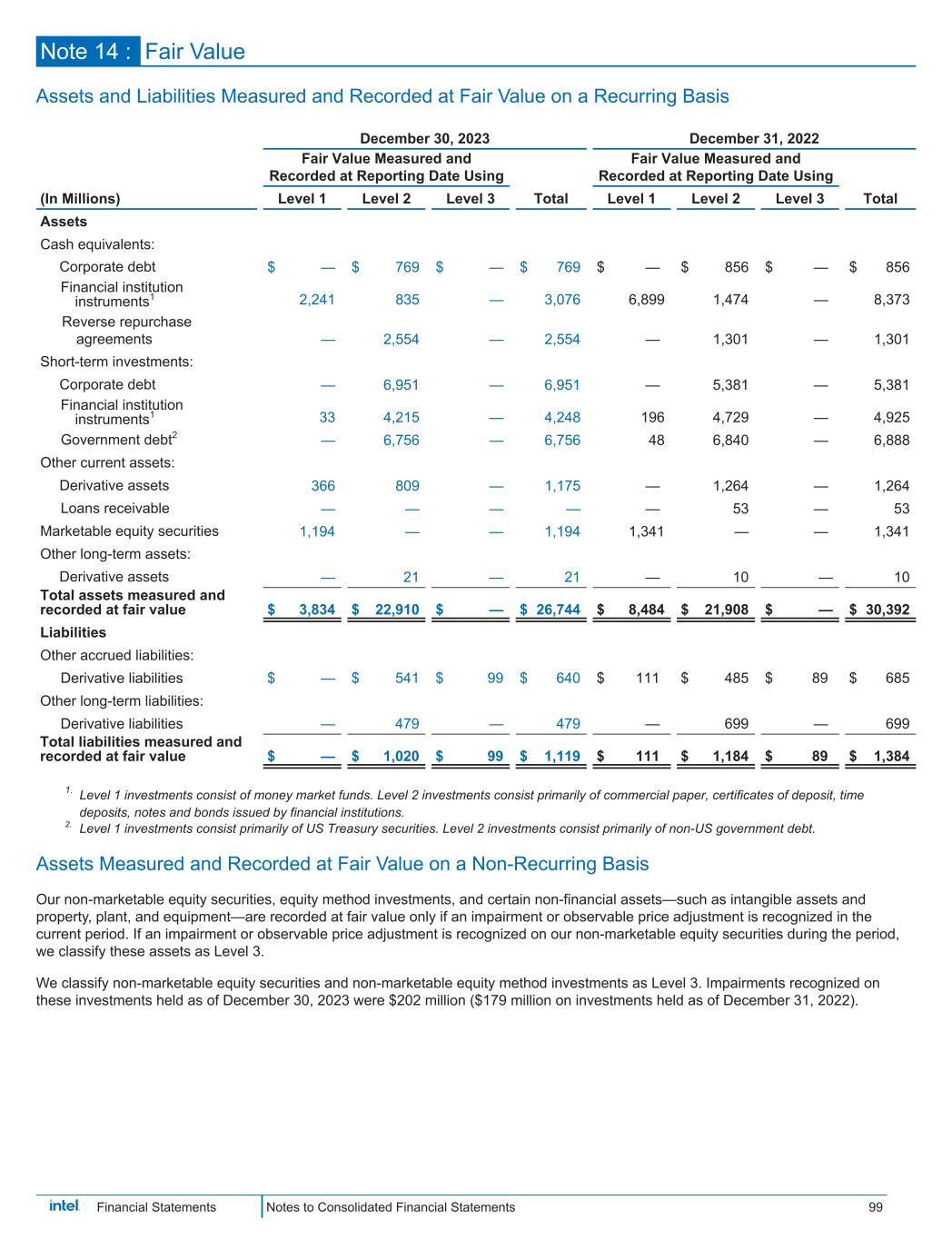

. *

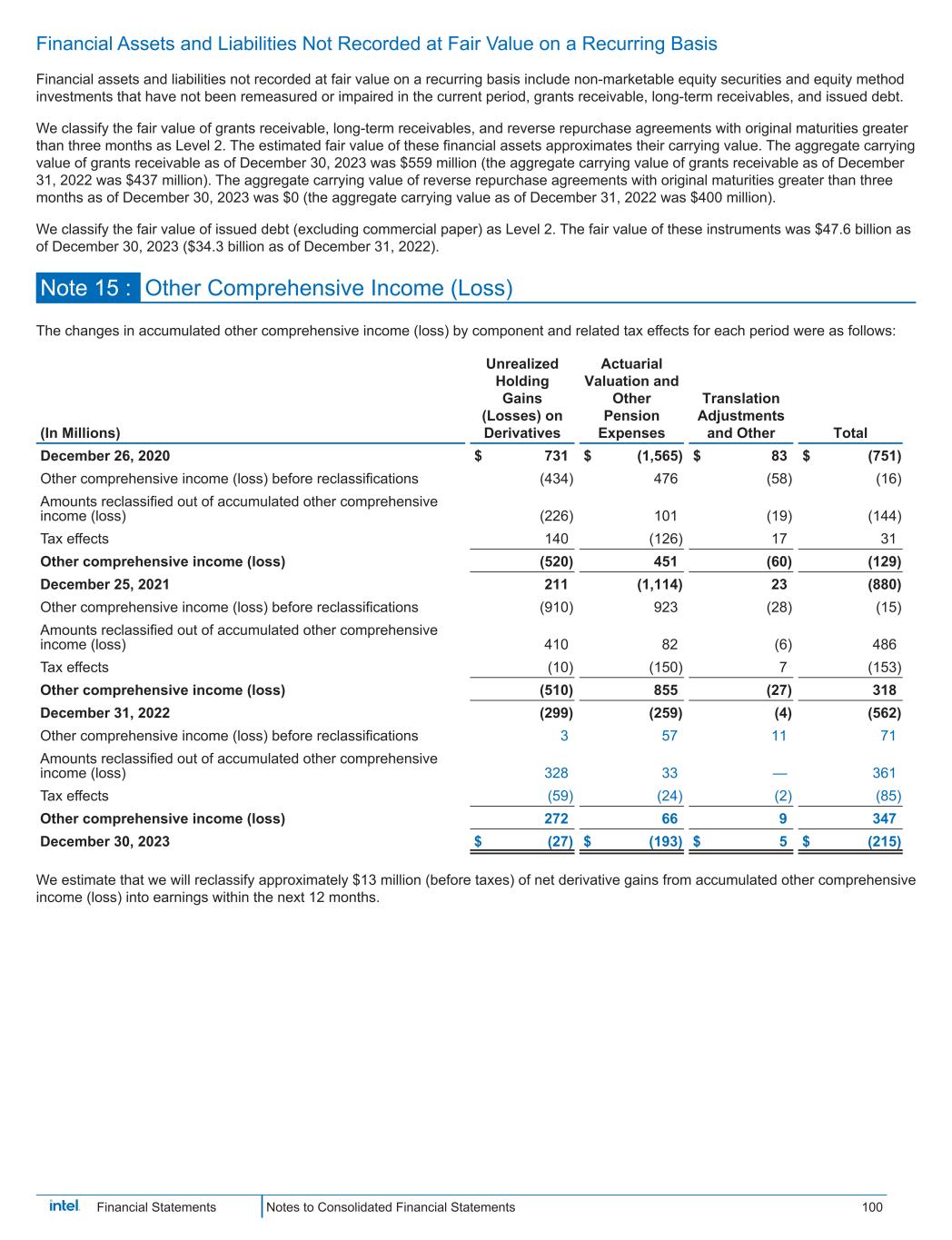

/

0

*

&

, 1

2

"3"4 &

-*"

3

$

$

$

2

#5 (

-

"3"6

&

&

"3"4

&

!"

#

&

7896:;

"3"6

4 6

$

&

"3

#5

&

"3"6

&

896:

,

896:

#6

2

<

= . 8

/

,

"3"6

.

>

0 ,

#5

<*+ &

6

63

$

"3"6 + &

"3

<

1 + &

%

$

#33

10

"3"8

$

%

%

&'

"343

, -

0

,

&

,

"3"4

#5

&

,

To support the growing demand for our foundry offering, we continued to expand our manufacturing capacity and capabilities. Our foundry collaborations have been bolstered by new strategic agreements with UMC to deliver a joint 12 nanometer process platform and with Tower Semiconductor to expand its wafer capacity corridor. Particularly noteworthy from Direct Connect was the deep support from ecosystem partners — including Synopsys, Cadence, Siemens and Ansys — that are ready to accelerate Intel Foundry customers' chip designs with tools, design flows and intellectual property portfolios validated for Intel's advanced packaging and Intel 18A process technologies. Accelerating Efforts to Bring Al Everywhere Intel is uniquely positioned across its product and foundry businesses to participate in 100% of the massive market for Al silicon, which is a key driver of the $1 trillion semiconductor opportunity expected by the end of this decade. Our efforts are to bring Al where data is generated and used and to extend across cloud, data centers, PCs, networks, and the edge. In 2023 we ushered in the age of the Al PC with Intel® CoreTM Ultra, the most significant transformation of the PC experience since the introduction of the wireless Intel Centrino platform more than 20 years earlier. We launched 4th Gen Intel® Xeon® processors with industry-leading Al inference performance, shipping 2.5 million units during the year, and 5th Gen Intel® Xeon® processors, which radically improved inference further. Our Intel® Gaudi®2 accelerators are exhibiting robust performance compared with peers, and Intel® Gaudi®3 is in the lab and powered on. Smart Capital remains a key component to our strategy as we prioritize critical investments to advance IDM 2.0. Intel also played a leading role in championing the passage of the U.S. CHIPS and Science Act to set the U.S. along the path to re-establishing global leadership in technology manufacturing. Looking Ahead to 2024 2023 was a year of consistent execution, where we achieved what we set out to do — and more. Thanks to the hard work of our talented and dedicated team, we have established a strong foundation for continued progress on our IDM 2.0 journey. In 2024, we aim to build on this progress and continue raising the bar with our ambitions. We remain relentlessly focused on our mission and committed to driving long-term value for our shareholders. We firmly believe Intel's brightest days lie ahead. Pat Gelsinger, CEO Intel Corporation 2023 was the year of Al training, but 2024 is poised to be the year of AI inferencing — where Intel is positioned to win. Demonstrating Strong Financial Improvement and Unlocking Shareholder Value Intel displayed strong financial discipline and improvement in 2023, consistently exceeding expectations on the top and bottom line for each of the four quarters. Through rigorous expense discipline, we achieved $3 billion in cost savings during the year. Additionally, at the beginning of 2024, we successfully transitioned to our internal foundry model. This model gives Intel Foundry its own profit-and-loss statement for the first time and establishes a foundry-like relationship between Intel Foundry and Intel Products. In 2023, we also unlocked significant value through strategic portfolio actions, including the stake sale of IMS. Along with the exit of 10 businesses since the second quarter of 2021, this culminated in approximately $1.8 billion in annual savings. This Annual Report contains forward-looking statements, and actual results could differ materially. Risk factors that could cause results to differ are set forth in the "Risk Factors" section and throughout our 2023 Form 10-K, which is included in this Annual Report. These risk factors are subject to update by our future filings and submissions with the U.S. SEC. Forward-looking statements included in our 2023 Form 10-K are based on management's expectations as of January 25, 2024, and forward-looking statements in the CEO letter are based on expectations as of March 15, 2024. Intel disclaims any obligation to update these statements, except as required by law. %

$

<

?*0

#"

% /

$

1

-

0

!

/

0

/

! ,

&

#5

'

$&'(

#33@

&

&

A#

$

<

$

10

&

"3"4

10

B 0C ?

10$

0

"3

6 . B =B

"

8

8 . B =B

< B .

B" $

B.

B4

"3"4

"3"6

!

)

%

& *

"3"4

$

$

%

$

A4

"3"6

%

,

&

, 1

"3"4

&

& */

$

#3

"3"#

$

A#

5

/ 0

&

2

-*"

3

?

/

0D1/ /

?

/

#

+,+- "3"4

$

!

% & &

-*"

3

"3"6

%

>

&

>

&

E>

&, E

"3"4,#3 F

>

%

&

?

/

/(0

, &

"3"4,#3 F G$

H "8

"3"6

&

0(< $

* #8

"3"6

$

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ▪ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 30, 2023. or n TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number: 000-06217 MEd® INTEL CORPORATION (Exact name of registrant as specified in its charter) Delaware 94-1672743 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 2200 Mission College Boulevard, Santa Clara, California 95054-1549 (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code: (408) 765-8080 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading symbol Name of each exchange on which registered Common stock, $0.001 par value INTC Nasdaq Global Select Market Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes 0 No 0 Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes 0 No 0 Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes 0 No 0 Indicate by check mark whether the registrant has submitted electronically every interactive data file required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes 0 No 0 Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer", "accelerated filer", "smaller reporting company", and "emerging growth company' in Rule 12b-2 of the Exchange Act. Large Accelerated Filer Accelerated Filer Non-Accelerated Filer Smaller Reporting Company Emerging Growth Company If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. 0 Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. 0 If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. 0 Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ❑ Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes 0 No 0 The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2023, based upon the closing price of the common stock as reported by the Nasdaq Global Select Market on such date, was $140.0 billion. 4,228 million shares of common stock were outstanding as of January 19, 2024. DOCUMENTS INCORPORATED BY REFERENCE Portions of the registrant's proxy statement related to its 2024 Annual Stockholders' Meeting to be filed subsequently are incorporated by reference into Part III of this Form 10-K. Except as expressly incorporated by reference, the registrant's proxy statement shall not be deemed to be part of this report.

.

/012345637 7

/893:

;

.

IJK L I

I I

;

.

IJJI

KJ

I

IJ 6<<2002632=:><?:8 !"

M J

IKJI

J KK

JK IJI :=/@/8: !"" J JIJINIK

J

II J

II

O J

LI

J J

200263 6==:4:#6>=:A/8; /35/ =/8/ /=2B6832/

IKKI

MNJPK !

KJI

J"KJ

NI

N

I

#$

"!$$ NIJKIKJI

NIKN

JJJ

$J J# 25=:6B:/C1C=/00 8/;2340D<?6= /<:6B:/C1:EC1/34:63@12C18:4205:8:; !

KJ%&$ IP N

'!

K

Q( J) I%J NIJKIKJI

NIKN

JJJ

$J J#

JL% I%JIKJI

JK R *%

R

K K

KKNI K

N +,JNIJK J-K

JL% I%JIKJI

JK

JIQNI

J IIJKNIKN

JJJ

$IJ

$,

J J-K

JL% I%RJIJIKJI

J$ K

IIJKIQNI

J

LJ

$I$,

JNIJKM

J$.+

NI

JI

$

JKIIKNKIJII

J JJIKJI

JR KIQNI

J KNIIJK

K

KNJJKN

IQNI

JKIJ KJ.

LK-K

JL% I%RJIJIKJI

J KKNJJ

JI

LPIL

JI JP

J IQNI

JKNJJ

NIKN

JJ

N +,

N J

*'S+,JK JI

NI

JI

$

JKIIKNKIJII

J JJIKJI

JR KIQNI

JKNJKN K-K

JL% I%RJIJIKJI

JK I I J

I

I J

I

* I J

I K IIIJ

LI

I

IRJ

LJ

J

KE I I J

IEE I J

IEEK IIIJ

LE

EI

IRJ

LE

N $*JM

J / I I J

I I J

I

* I J

I I

IJ

!

L I

(IRJ!

L

I

IRJ

L

JL% I%JIKJI

J K J

JJNKJMJ

JI

KJ

I

I L

RJ

L

RI IPK

N

J

KJ

I

KIP

NIKN

JJJ

$ JM

J

JL% I%RJIJIKJI

J K

IIJ

JJKJ J

JJK

J"K KKKK

JJJP

KKJK

JI

JI PI

IIJ

N

IJ

++J I

K*0M L J$,1!23LJIKJI

N N

J

IJ JI I

IKKN

JK N

JIIJ

KNIJK IIKJI

NIKN

JJJ

$J J

JL% I%RJIJ

KJ J

JKJIKJI

J

N

J

I JJIIJ

IIIJIPNK LKKN

KJ J

JK

JL% I%RJI

LJKIIIIIJ

K IIKJ J

JKJ JIQNI

IPIL

LKK

JP* K

K J

IP

L

LJIKJI

JTKMNJPIK

NI

JI P

JIPILI

NIKN

JJS+$ *$

JL% I%RJIJIKJI

JK K

L K

N $*JM

J-K

' I J I%JP NPJ

*PJ

QNJL

L

* JKJIKJI

J K4N

K

N

J K

IJ

KJ% KIIJ

LJ

K

Q( J) I%J

KN

JR K&$+

+5

K IK

KJ%RI NJKJ

K4

N IL$.+

#F

6IJ

KJIKJI

J"KIMLKJ J

JI J

JJK+

N J%

IK")J

J

KNKQN

J L I

II J

LII

J 6 IJ

JKI$*7MJ KMIKK L

II J

LII

JIKJI

J"KIMLKJ J

JK

J

J IJJKIIJ

This page intentionally left blank. K J J

L

J

Table of Contents Organization of Our Form 10-K The order and presentation of content in our Form 10-K differs from the traditional SEC Form 10-K format. Our format is designed to improve readability and better present how we organize and manage our business. See "Form 10-K Cross-Reference Index" within the Financial Statements and Supplemental Details for a cross-reference index to the traditional SEC Form 10-K format. We have defined certain terms and abbreviations used throughout our Form 10-K in "Key Terms" within the Financial Statements and Supplemental Details. The preparation of our Consolidated Financial Statements is in conformity with US GAAP. Our Form 10-K includes key metrics that we use to measure our business, some of which are non-GAAP measures. See "Non-GAAP Financial Measures" within MD&A for an explanation of these measures and why management uses them and believes they provide investors with useful supplemental information. Fundamentals of Our Business Page Availability of Company Information 2 Introduction to Our Business 3 A Year in Review 5 Our Strategy 7 Our Capital 10 Management's Discussion and Analysis Our Products 20 Segment Trends and Results 21 Consolidated Results of Operations 37 Liquidity and Capital Resources 42 Critical Accounting Estimates 44 Non-GAAP Financial Measures 45 Risk Factors and Other Key Information Risk Factors 48 Sales and Marketing 63 Quantitative and Qualitative Disclosures About Market Risk 64 Cybersecurity 65 Properties 66 Market for Our Common Stock 66 Stock Performance Graph 67 Issuer Purchases of Equity Securities 67 Rule 10b5-1 Trading Arrangements 67 Information About Our Executive Officers 68 Disclosure Pursuant to Section 13(r) of the Securities Exchange Act of 1934 69 Financial Statements and Supplemental Details Auditor's Reports 71 Consolidated Financial Statements 74 Notes to Consolidated Financial Statements 79 Key Terms 112 Controls and Procedures 114 Exhibits 115 Form 10-K Cross-Reference Index 120

J JK I OJ

NI I II IK JJ

J J NI I

IK

I JJIJ

I

IJ

NI

IJKK J I PI

JL JJIIK J RR I O NI NK KK

E II KK

I MERJ J

JJ JK N

J

J

K

II KKI

I MJ JJIJ

I

IJ

!P

IJ JIK IPJ KNKJI N NJ NI I ELIKERJ J

JJ JK N

J

J

K

IIJ

NI K

J

JJ JKK

IJLRJ1"##$

NI I

NKLJIKJJR NKJ KNI NI NK KK%K

RI "##$KNIK

E& "##$

'KNIKERJ ' (#

I M

J

JKKNIK RL JNKKJ

PKJLI P PKJ IKRJNK

N

KN

J

IJ

N J

K

NI)NK KK $ #P

JL

L

IJ * JI NJ J NI)NK KK + #,I

PR - NIJIJL . NIJ

' J/K KNKK #

LKK NI$I NJK * JI K

KN

JK * K

J

KN

JK

IJ K +. 0QNJL J

K NIK 1* IJ

# N J

KJJK 11 & "##$

'KNIK 1-

KJ IK JIL

IJ

KJ IK 12

K 'IJ 3+ 4N JJJP 4N

JJP K

KNIK# NJ'IJ

K 31 L IKNIJL 3- $I IJK 33 'IJ

INI J 33 J $I

I "I 3. KKNI$NIKK

QNJLNIJK 3.

N

-I #II JK 3.

IJ # NJNI

MNJP

IK 32 K

KNI$NIKN JJ J +5I6

JNIJK

M #J

7+1 37

JJ JK N

J

J

K #NJ I/K

IJK . K

J

JJ JK .1 & JKJ K

J

JJ JK .7 LIK * JI

K $I NIK 1

M JK - II KK

I M *

This page intentionally left blank. K J J

L

J

Forward-Looking Statements This Form 10-K contains forward-looking statements that involve a number of risks and uncertainties. Words such as "accelerate", "achieve, "aim", "ambitions", "anticipate, "believe", "committed", "continue, "could", "designed", "estimate, "expect", "forecast", "future, "goals", "grow", "guidance, "intend", "likely", "may", "might'', "milestones", "next generation", "objective, "on trace, "opportunity", "outlook", "pending", "plan", "position", "possible", "potential", "predict", "progress", "ramp", "roadmap", "seer, "should", "strive, "targets", "to be, "upcoming", "will", "would", and variations of such words and similar expressions are intended to identify such forward-looking statements, which may include statements regarding: our business plans and strategy and anticipated benefits therefrom, including with respect to our IDM 2.0 strategy, our Smart Capital strategy, our partnership with Brookfield, the transition to an internal foundry model, updates to our reporting structure, and our Al strategy; • projections of our future financial performance, including future revenue, gross margins, capital expenditures, and cash flows; • projected costs and yield trends; • future cash requirements, the availability, uses, sufficiency, and cost of capital resources, and sources of funding, including for future capital and R&D investments and for returns to stockholders, such as stock repurchases and dividends, and credit ratings expectations; future products, services, and technologies, and the expected goals, timeline, ramps, progress, availability, production, regulation, and benefits of such products, services, and technologies, including future process nodes and packaging technology, product roadmaps, schedules, future product architectures, expectations regarding process performance, per-watt parity, and metrics, and expectations regarding product and process leadership; investment plans and impacts of investment plans, including in the US and abroad; • internal and external manufacturing plans, including future internal manufacturing volumes, manufacturing expansion plans and the financing therefor, and external foundry usage; • future production capacity and product supply; • supply expectations, including regarding constraints, limitations, pricing, and industry shortages; • plans and goals related to Intel's foundry business, including with respect to anticipated customers, future manufacturing capacity and service, technology, and IP offerings; • expected timing and impact of acquisitions, divestitures, and other significant transactions, including the sale of our NAND memory business; • expected completion and impacts of restructuring activities and cost-saving or efficiency initiatives • future social and environmental performance goals, measures, strategies, and results; • our anticipated growth, future market share, and trends in our businesses and operations; • projected growth and trends in markets relevant to our businesses; • anticipated trends and impacts related to industry component, substrate, and foundry capacity utilization, shortages, and constraints; • expectations regarding government incentives; • future technology trends and developments, such as Al; • future macro environmental and economic conditions; • geopolitical tensions and conflicts and their potential impact on our business; • tax- and accounting-related expectations; • expectations regarding our relationships with certain sanctioned parties; and other characterizations of future events or circumstances. Such statements involve many risks and uncertainties that could cause our actual results to differ materially from those expressed or implied, including those associated with: the high level of competition and rapid technological change in our industry; the significant long-term and inherently risky investments we are making in R&D and manufacturing facilities that may not realize a favorable return; the complexities and uncertainties in developing and implementing new semiconductor products and manufacturing process technologies; our ability to time and scale our capital investments appropriately and successfully secure favorable alternative financing arrangements and government grants; implementing new business strategies and investing in new businesses and technologies; changes in demand for our products; macroeconomic conditions and geopolitical tensions and conflicts, including geopolitical and trade tensions between the US and China, the impacts of Russia's war on Ukraine, tensions and conflict affecting Israel, and rising tensions between the US and Taiwan; the evolving market for products with Al capabilities; Intel. 1 IRI0 JJ JK K I J K

IRI

KJJ JKJJ P

P N I

IKK N IJ JK

! IKKNKE

IJE% EPE%EE%E J KE%E JJE%E

PE%E JJE%E J NE%E N

E%EK E%EKJJE%EMJE%E

IKJE%E

NJNIE% E

KE%EI RE%EN E%E J E%E

LE%ELE%EJE%E

KJ KE%E MJ IJ E%E 8JPE%E JIE%E IJN JLE% E NJ

E%E E%E

E%E KJ E%E KK

E%E J J

E%EIJE%EI IKKE%EIE%EI E%EKE%EK N

E%EKJIPE%EJIJKE% EJ E%EN E%ER

E%ER N

E% PIJ K

KNR IK K

IMIKK KI J J J

LKN

IRI

KJJ JK%RL

NKJJ JKII 9 U NI NK KK

K KJIJL JJ

JKJI

I %

N RJIKJJ NI '*

KJIJL% NIIJJ

KJIJL% NIIJ IKRJ)I

%JJI KJ J JI

N IL

%NJKJ NII IJ KJINJNI% NI# KJIJL: U I 8J K

NI

NJNI

I

I %

N

NJNIIP N%I KKI K%J

M JNIK% K

RK: U I 8J KJK L

JI K: U

NJNIKIQNI JK%JP

JL%NKK%KN

L% KJ

J

IK NIK% K NIK

N %

N

I

NJNI J

( PKJ JK

IIJNI KJ KJ

IK%KNKKJ INIKK P K% IJIJ K MJJ K: U

NJNII NJK%KIPK% J

K% JMJ

K%J

%IK%I IKK%P

JL%I NJ %IN

J %

JK

KNI NJK%KIPK% J

K%

N

NJNII KK K J

L%I NJ I K%KN

K%

NJNII NJIJJNIK%MJJ KII I KKI

I %IRJJIJL% JIK% MJJ KII I NJ I KK

IK: U PKJ J

K JK

PKJ J

K%

N J1 I : U JI

MJI

N

JNI

K%

N

NJNI JI

N

JNI P

NK% N

JNI M K

K J

JI

I% MJI

N ILNK: U

NJNII NJ JL I NJKN

L: U KN

LMJJ K%

N II KJI JK%

JJ K%I % NKJILK IJK: U

K

KI

JJ J

/K

N IL NK KK%

N RJIKJJ JJNKJ IK%

NJNI N

JNI JL KIP%J

L% $

I K: U MJJ J

QNKJ K%PKJJNIK% JIK

JJI KJ K%

N JK

NI&#& IL NK KK: U MJ

J JK

IKJINJNI JPJK KJKP I

L JJPK U

NJNIK

PI J

I

I

K%KNIK%KJIJK% IKN

JK: U NI JJI RJ%

NJNIIJKI% JI K NI NK KKK IJ K: U I 8JI RJ JI K IJKI

P JJ NI NK KKK: U JJJI K JKI

JJ NKJIL J%KN KJIJ%

N ILJLNJ

OJ %K IJK% KJI JK: U MJJ KII PI J JPK: U

NJNIJ

LJI K P

JK%KNK# : U

NJNII PI J

J K: U

J

J K K

JK JI J J

J NI NK KK: U JM N J I

JMJJ K: U MJJ KII NII

J KKRJIJ K J IJK: U JIIJIOJ K

NJNIP JK IINKJ K

NKJJ JK P

P LIKK N IJ JKJJ N

NK NIJN

IKN

JKJ

IJI

L

I J KMIKK I

%

N J KKK JRJ9 U J

P

JJ IJ

NI NKJIL: U JK

J

JI I J

LIKL PKJ JKRI

( N

JNI

JKJJL JI

O

P I

IJNI : U J

MJK N IJ JK P

J RK NJ II NJK N

JNI I KK J

K: U NI

JLJ J K

NIJ

PKJ JKI IJ

L KNKK

N

LKNI

P I

JI JP

II JK PI JI JK: U

J R NK KKKJIJK PKJ R NK KKK J

K: U K

I NII NJK: U I J K

J

J K K

JK%

N

J

JIJ K K JR J1 %JJK

NKK/KRI 1I %J K K

J

J KI

% IK J K K JR J1 R : U JP

P IJ

II NJKRJ#

JK:

• our complex global supply chain, including from disruptions, delays, trade tensions and conflicts, or shortages; • product defects, errata and other product issues, particularly as we develop next-generation products and implement next-generation manufacturing process technologies; • potential security vulnerabilities in our products; • increasing and evolving cybersecurity threats and privacy risks; • IP risks including related litigation and regulatory proceedings; • the need to attract, retain, and motivate key talent; strategic transactions and investments; sales-related risks, including customer concentration and the use of distributors and other third parties; our significantly reduced return of capital in recent years; our debt obligations and our ability to access sources of capital; • complex and evolving laws and regulations across many jurisdictions; • fluctuations in currency exchange rates; • changes in our effective tax rate; catastrophic events; environmental, health, safety, and product regulations; our initiatives and new legal requirements with respect to corporate responsibility matters; and other risks and uncertainties described in this report and our other filings with the SEC. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Readers are urged to carefully review and consider the various disclosures made in this Form 10-K and in other documents we file from time to time with the SEC that disclose risks and uncertainties that may affect our business. Unless specifically indicated otherwise, the forward-looking statements in this Form 10-K do not reflect the potential impact of any divestitures, mergers, acquisitions, or other business combinations that have not been completed as of the date of this filing. In addition, the forward-looking statements in this Form 10-K are based on management's expectations as of the date of this filing, unless an earlier date is specified, including expectations based on third-party information and projections that management believes to be reputable. We do not undertake, and expressly disclaim any duty, to update such statements, whether as a result of new information, new developments, or otherwise, except to the extent that disclosure may be required by law. Note Regarding Third-Party Information This Form 10-K includes market data and certain other statistical information and estimates that are based on reports and other publications from industry analysts, market research firms, and other independent sources, as well as management's own good faith estimates and analyses. Intel believes these third-party reports to be reputable, but has not independently verified the underlying data sources, methodologies, or assumptions. The reports and other publications referenced are generally available to the public and were not commissioned by Intel. Information that is based on estimates, forecasts, projections, market research, or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances reflected in this information. Intel, Arc, Arria, Celeron, Intel Agilex, Intel Atom, Intel Core, eASIC, Intel Evo, FlexRAN, Granulate, the Intel logo, Intel Optane, Intel Unison, MAX, Movidius, Open VINO, Open VINO logo, Pentium, Stiatix, Thunderbolt and the Thunderbolt logo, Intel vPro, and Xeon are trademarks of Intel Corporation or its subsidiaries. The Bluetooth® word mark and logos are registered trademarks owned by Bluetooth SIG, Inc. and any use of such marks by Intel Corporation is under license. • Other names and brands may be claimed as the property of others. Availability of Company Information We use our Investor Relations website, www.intc.com, as a routine channel for distribution of important, and often material, information about us, including our quarterly and annual earnings results and presentations, press releases, announcements, information about upcoming webcasts, analyst presentations, and investor days, archives of these events, financial information, corporate governance practices, and corporate responsibility information. We also post our filings on this website the same day they are electronically filed with, or furnished to, the SEC, including our annual and quarterly reports on Forms 10-K and 10-Q and current reports on Form 8-K, our proxy statements, and any amendments to those reports. All such information is available free of charge. Our Investor Relations website allows interested persons to sign up to automatically receive e-mail alerts when we post financial information and issue press releases, and to receive information about upcoming events. We encourage interested persons to follow our Investor Relations website in addition to our filings with the SEC to timely receive information about the company. Intel. 2 U NI

M

KN

L %

N

I KINJ K%

LK%JIJ K K

JK% IK IJK: U I NJ

JK%IIJ JII NJKKNK%IJN

I

LKRP

MJ IJ I NJK

J MJ IJ N

JNI I KKJ

K: U J J

KNIJLPN

I

JK NII NJK: U IK P

P L IKNIJLJIJK IPLIKK: U $IKK

N I

J

JJ IN

J ILI K: U J J JJIJ%IJ % JPJLJ

J: U KJIJJI KJ K PKJ JK: U K

KI

JIKK%

N NKJ I JIJ JNK

KJI NJ IK JIJIIJK: U NIK

J

LINIJNI

J

I JLIK: U NI J

J K NI

JLJ KKK NIK

J

: U

M P

P

RK IN

J KI KK L8NIKJ K: U

NJNJ K NII LM IJK: U K NI

JPJMIJ: U JKJI P JK: U PI J

%

J%K

JL% I NJIN

J K: U NI JJPK R

IQNI JKRJIKJJ I IJIK K

JLJJIK: U JIIKK N IJ JKKI JKI IJ NI JI

KRJJ

"P JKIKK N IJ JK%IIKINJ JJ

N NI

KN

IRI

KJJ JK

IKI NIJ I

N

LIPR KIJPI NKK

KNIK JK I JI N JKR

I JJ J RJJ

JJK

KIKK N IJ JKJJL

J NI NK KK

1

KKK

L J JIRK%J

IRI

KJJ JK JK I JI

JJ J J

J

L PKJJNIK%IIK%QNKJ K% I JI NK KK J KJJP J

JK

JJ

JK

J % J

IRI

KJJ JK JK II K J/KMJJ KK

JJ

JK

%N

KK I

I JKK

%

N MJJ K K JIIJL

IJ I 8J KJJ J

PKJ INJ

! JN IJ% MIKK

LK

LNJL%J NJKNKJJ JK%RJIKIKN

J

R

IJ % RP

JK% I JIRK%MJJ JMJ JJJK

KNIL IQNI L

R

& J

I I$IJL

IJ K I

NKIJJ IJ JIKJJKJ

IJ KJJKJJI K I IJK JI N

J K

I NKJIL

LKJK%IJIKI

IK% JI JK NIK%KR

K J/K R

J KJJK

LKK

J

PKJKJIIJLI IJKJ INJ

% NJK J J

LPI

JN I

L J K NIK%J

K% IKKNJ K

I IJK JIN

J KI

I I I

LP

J JN

RI J KK L J

IJ JJK K KJJK%

IKJK%I 8J K%IJIKI% IK

IJ

KK I J

LKN 8JJ N IJ JK% JN

P JK IINKJ KL

IJI

L

I P JK INKJ KI

J JK

IJ

!"!!#$% !&

'# (

&)

%&! *

%

+,&- (./0!$

1 $

2

&'&

34

$

5

#6&

787&,#9#1634

:

/3 34

:

/3 &'&;

#1)*

!$

#(<21

9 !=&

$

9

2 <21

9 !=&

&'&

,;!&$

98 &

$!

!$9 )$!>6&?

%&!4&!$

#&

&!#

661=6#9#$!# 6 <2 @ 1

&&

2AB&!9)$!>$

9 &'&6$! ! '#6

! 9

!$9 )$!>6&B

9=C@ 1

&&

2*

0

"$

9$

C16 &?61"2)$!>6=C

%&!4&!$

#&

#61

9 ! #"

6 3

2 !

$) 6$

9=!$

96)$C= " $#) 9$6

2 4!&4 !

C&?&

2 !6 #P

JL

L

IJ !NK NI PKJ I

J KR KJ%BBB#

""&)KI NJ

IKJI NJ

IJ J%

J JI

%

IJ NJNK%

N NIQNIJI

L N

I KIKN

JK IK JJ K%IKKI

KK% N JK%

IJ NJ N R KJK%

LKJIK JJ K% PKJ ILK%IPK

JKP JK%

IJ % I IJ PI IJK% I IJIK K

JL

IJ

!

K KJ NI

K JKR KJJKLJLI

JI

L

RJ% I

NI KJ %J

%

N NI N

QNIJI

LI IJK IK 4 NII JI IJK I2% NII ML KJJ JK% L JKJ J KI IJK

#

KN

IJ KP

I

I

NI PKJ I

J KR KJ

RK JIKJIK KJ K NJ NJ J

LIP

IJKR R KJ

IJ KKNIKKI

KK% J IP

IJ NJN P JK

! NI JIKJIK KJ

R NI PKJ I

J KR KJ J J NI

KRJJ

J J

LIP

IJ NJJ L

*

.... ........ 1,1EE pulp .g .tz "MS' a Imr. 11111111111 I i ," '22b .m.ssiquit II::: • la = "Hutu lislrbvii .== 1=7: nii.sliti 0=z, llis -.I' thihi I" 1 Is it ......1 11,._ i _ nums itl iiiiii " T asts.... We are an Industry leader and a catalyst for technology innovation and products that revolutionize the way we live. We are committed to harnessing the breadth and scale of our reach to have a positive effect on business, society, and the planet. Our purpose is to create world-changing technology that improves the life of every person on the planet. in r i e

if

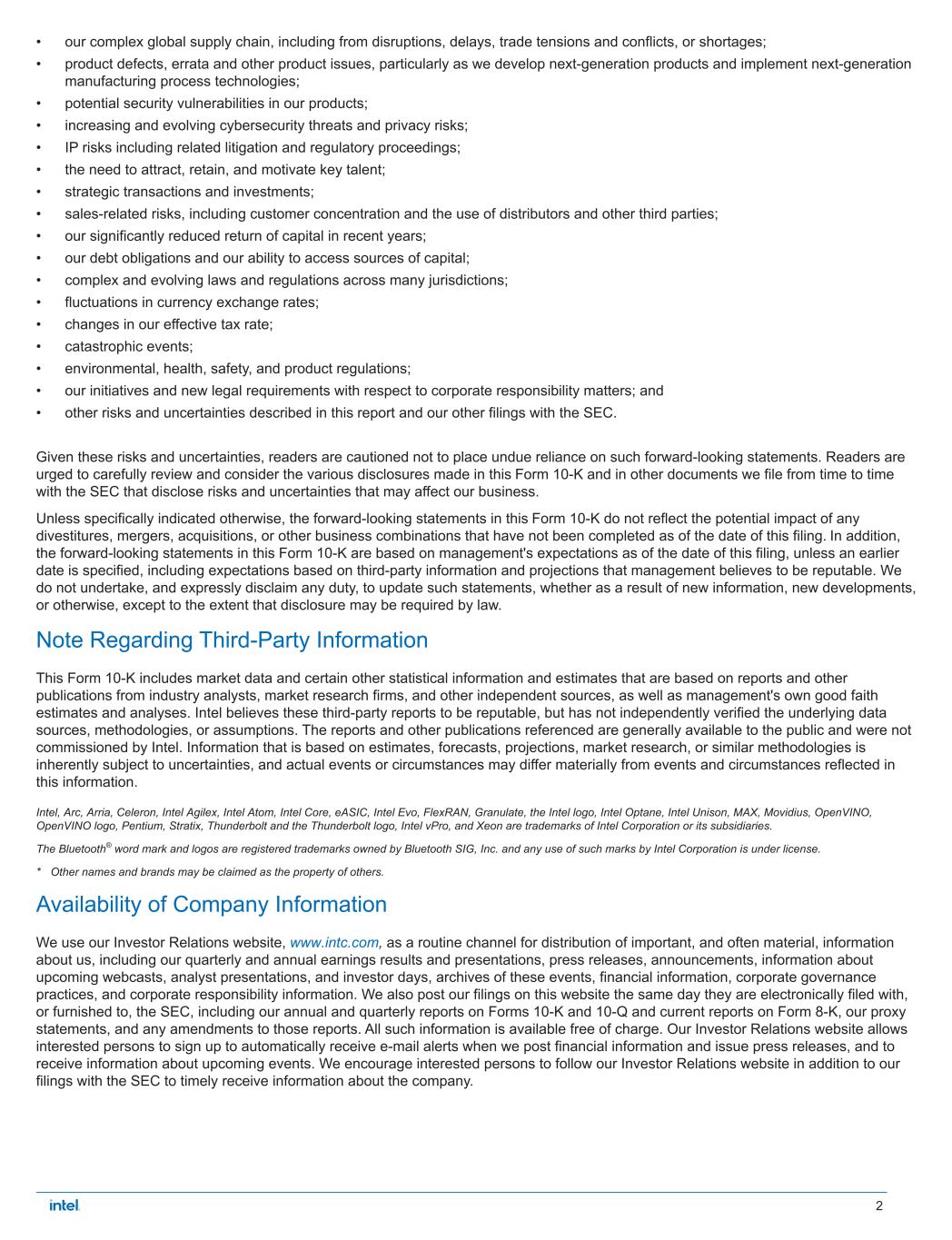

Introduction to Our Business We are committed to creating world-changing technology that improves the life of every person on the planet—we are the technology the world builds on. We have the opportunity to push the boundaries of what's possible and to create solutions to the world's biggest challenges. As technology permeates every aspect of our lives, we see an insatiable demand for processing power. That is why we are opening our manufacturing network to the world and creating the resilient supply chain industries need. It's why we are bringing the full breadth of our silicon and software to bear by bringing Al everywhere—from the client to the data center to the edge. It's why we continue our relentless pursuit of Moore's Law to unlock innovation and spark new ecosystems. Much as oil has defined geopolitics for the past five decades, technology supply chains and where semiconductors are built will define the next five decades. With one of the most geographically balanced supply chains across North America, Europe and Asia, we lead the way in creating open, end-to-end value chains that the US and Europe seek for resiliency and security—and that, for the first time, gives the ecosystem a true alternative to other foundries. We are at a pivotal moment in Al technology. AI is an incredibly powerful technology with untold potential, but it's still relatively immature. We must ensure Al technology advances responsibly. Intel defines the spirit of Moore's Law as relentless innovation and pursuit of exponential leaps in computing power—all in close collaboration with our customers. But we're not finished yet. Continuous innovation is the cornerstone of Moore's Law. We do this because we are committed to being an excellent partner for the next era of compute: creating trusted environments, collaboratively innovating and delivering exceptional engineering, from silicon to services. The possibilities are limitless. It starts with Intel. "Semiconductors are essential to maintaining and enabling modern society and there are infinite possibilities as we enter the age of Al. Our strategy for reclaiming process and product leadership, bringing Al everywhere and driving a resilient, diverse and balanced supply chain, puts Intel in the position to help define the future of technology." — Pat Gelsinger, Intel CEO

I

l .”

!"# ’ ’

$ ’ I f ’ i ’ %

$

&

'

"

((

)*

" + $

$

I

, / I

$ %, 0

$ &

1 ,

!

$ ’

&

$

& $

2

&

“

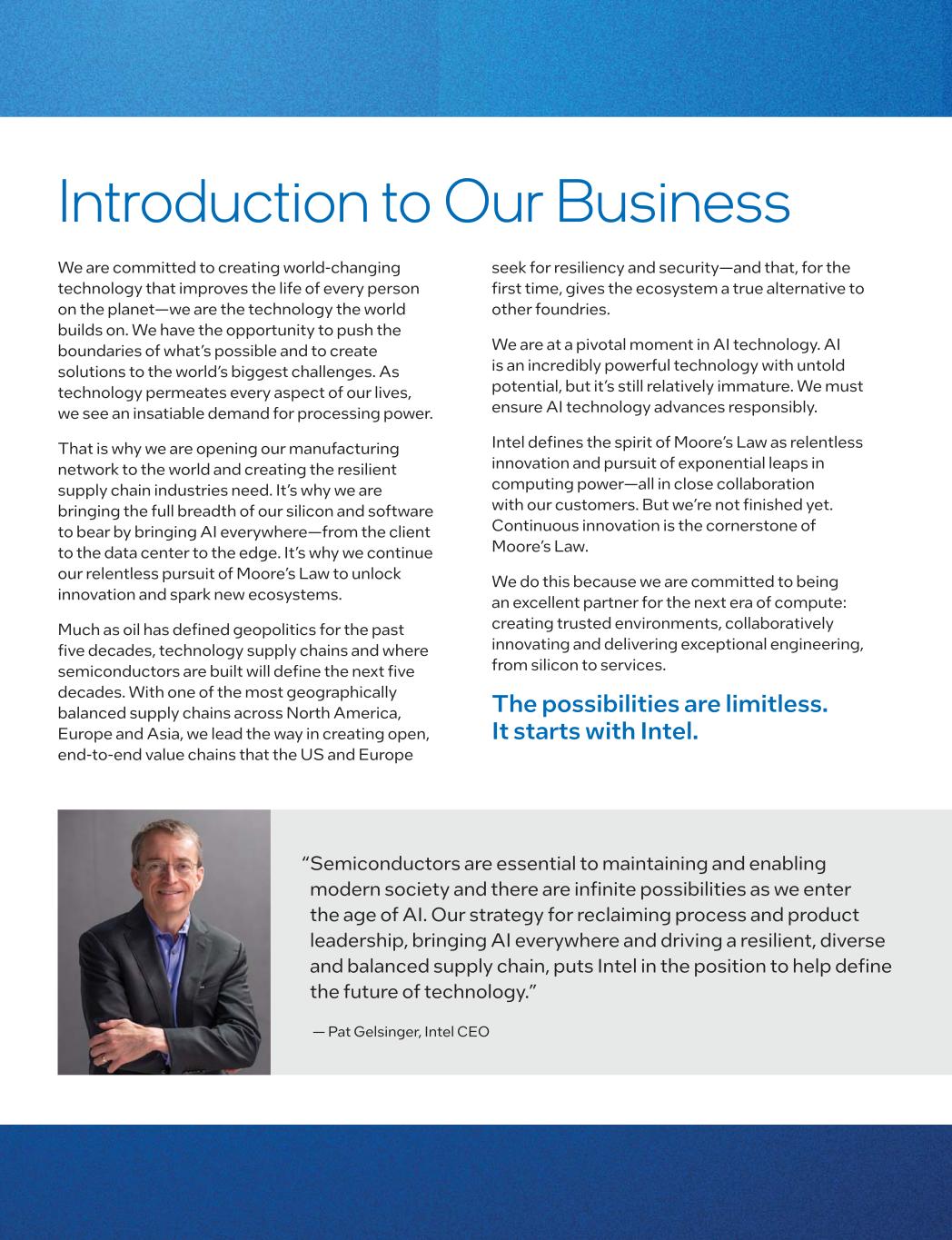

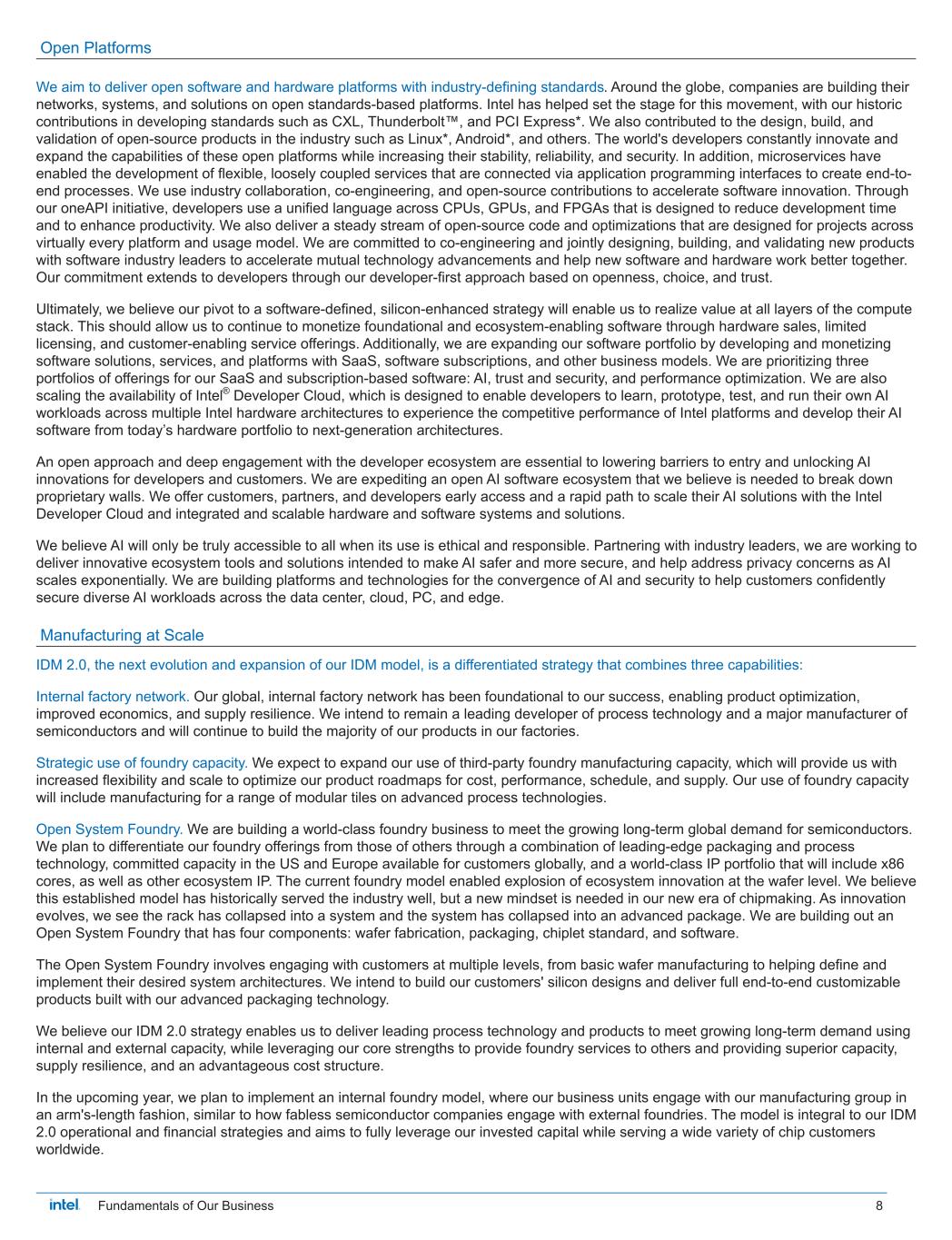

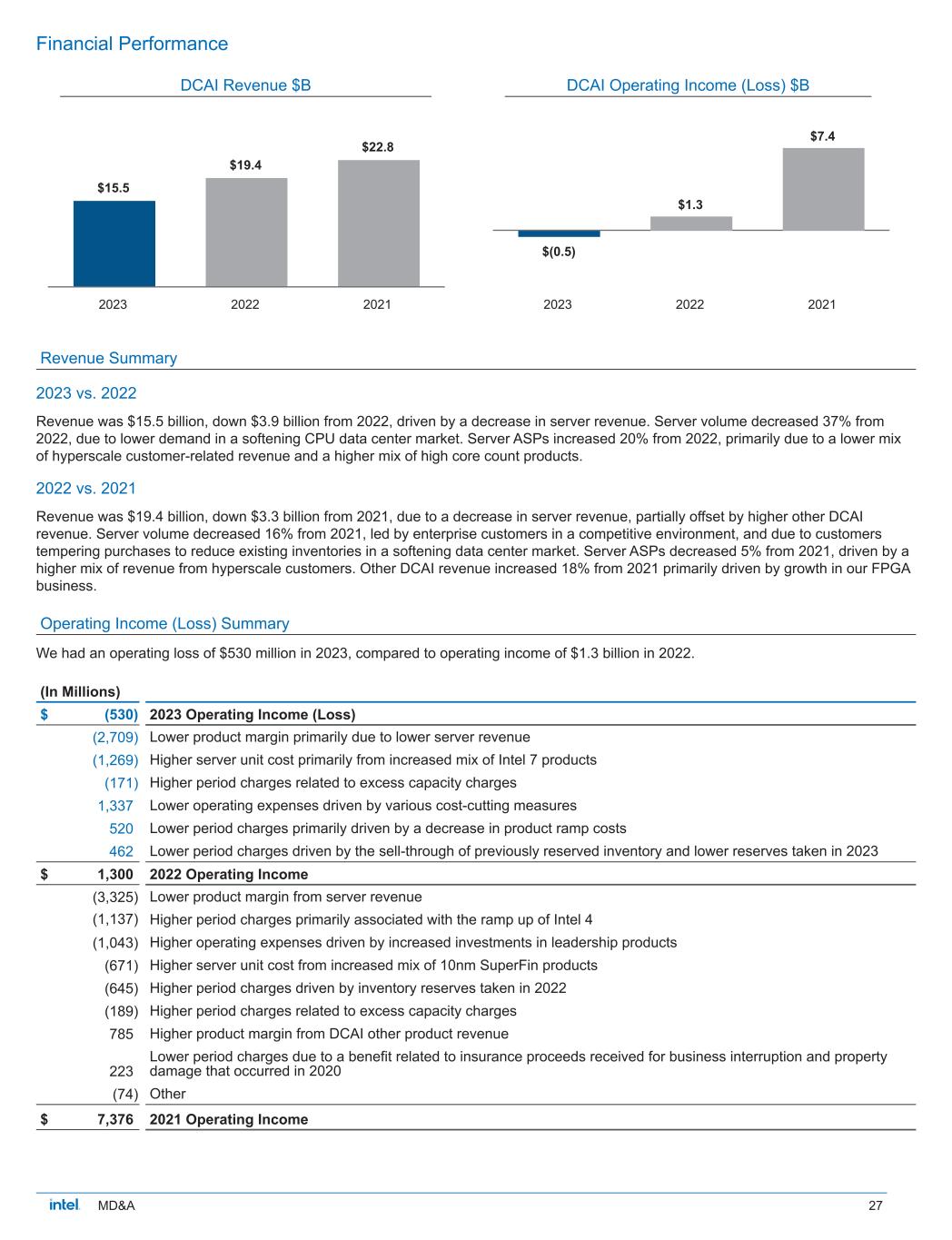

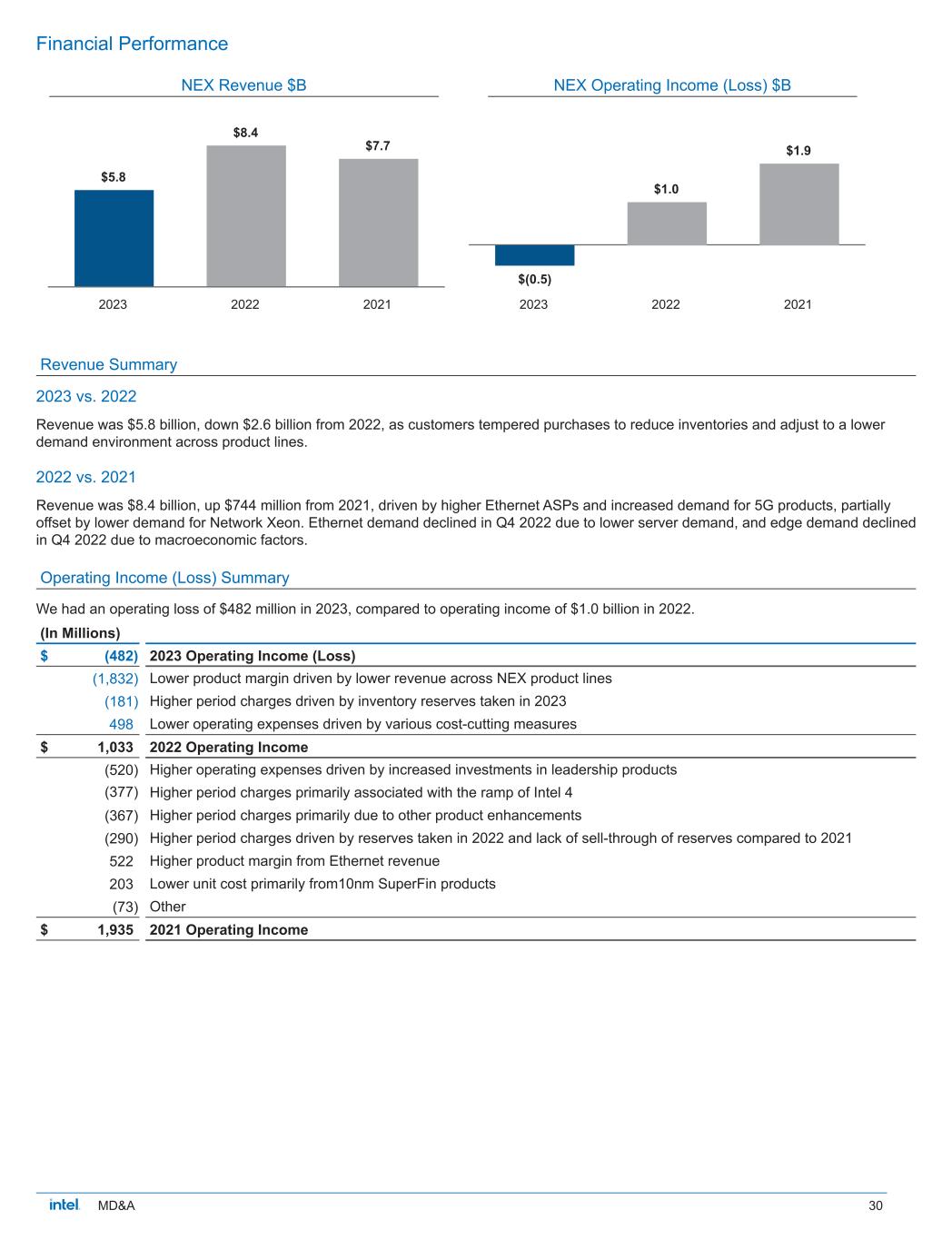

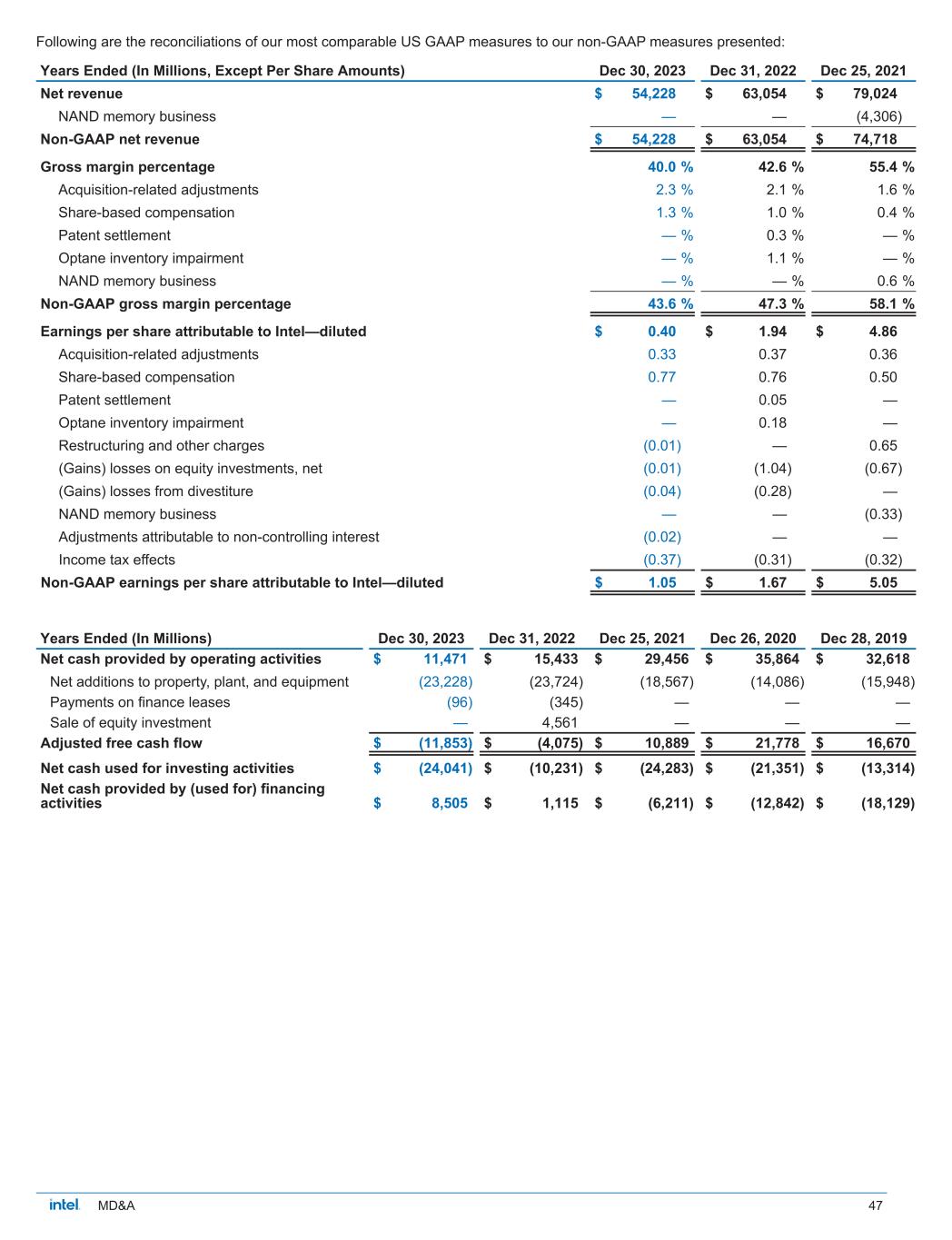

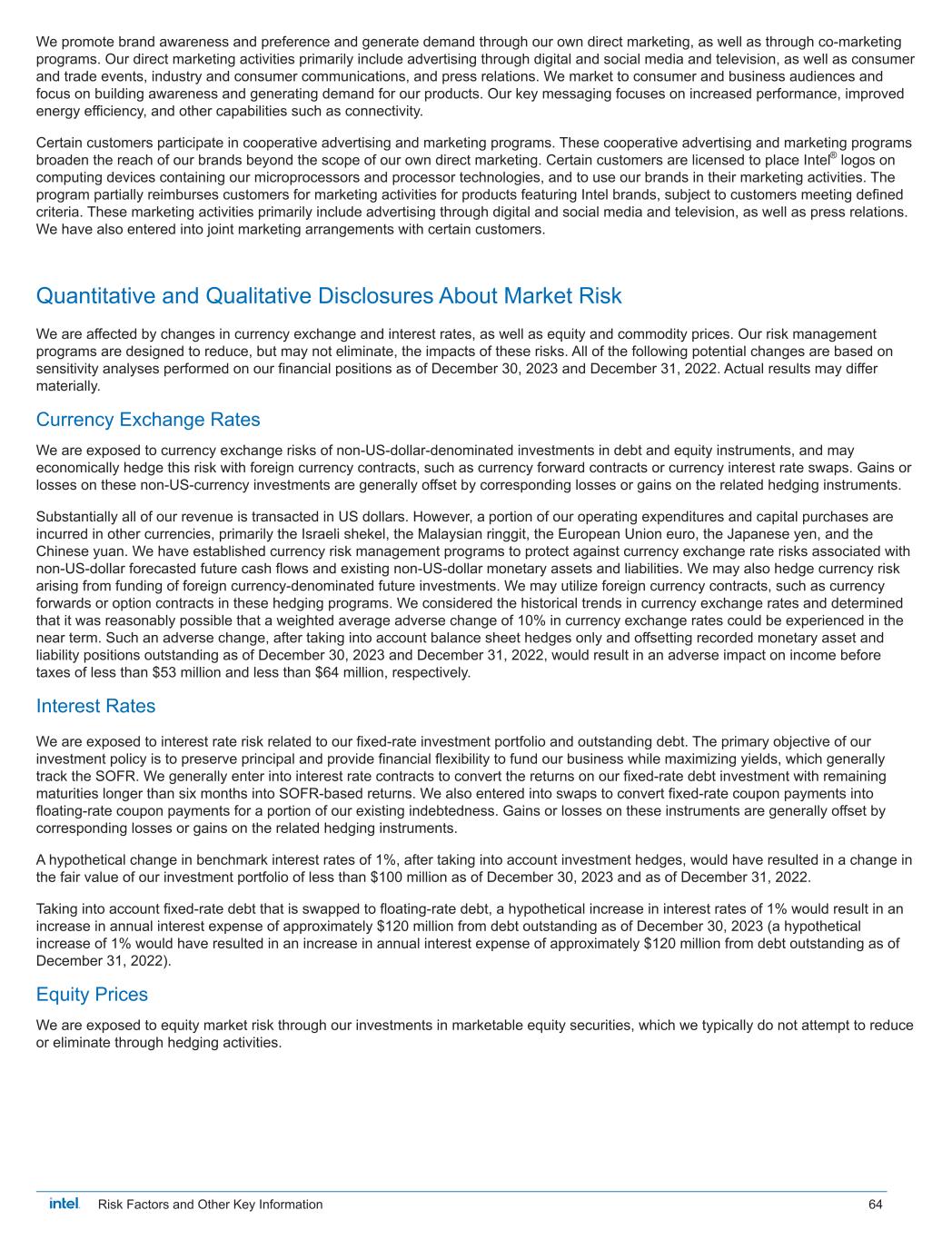

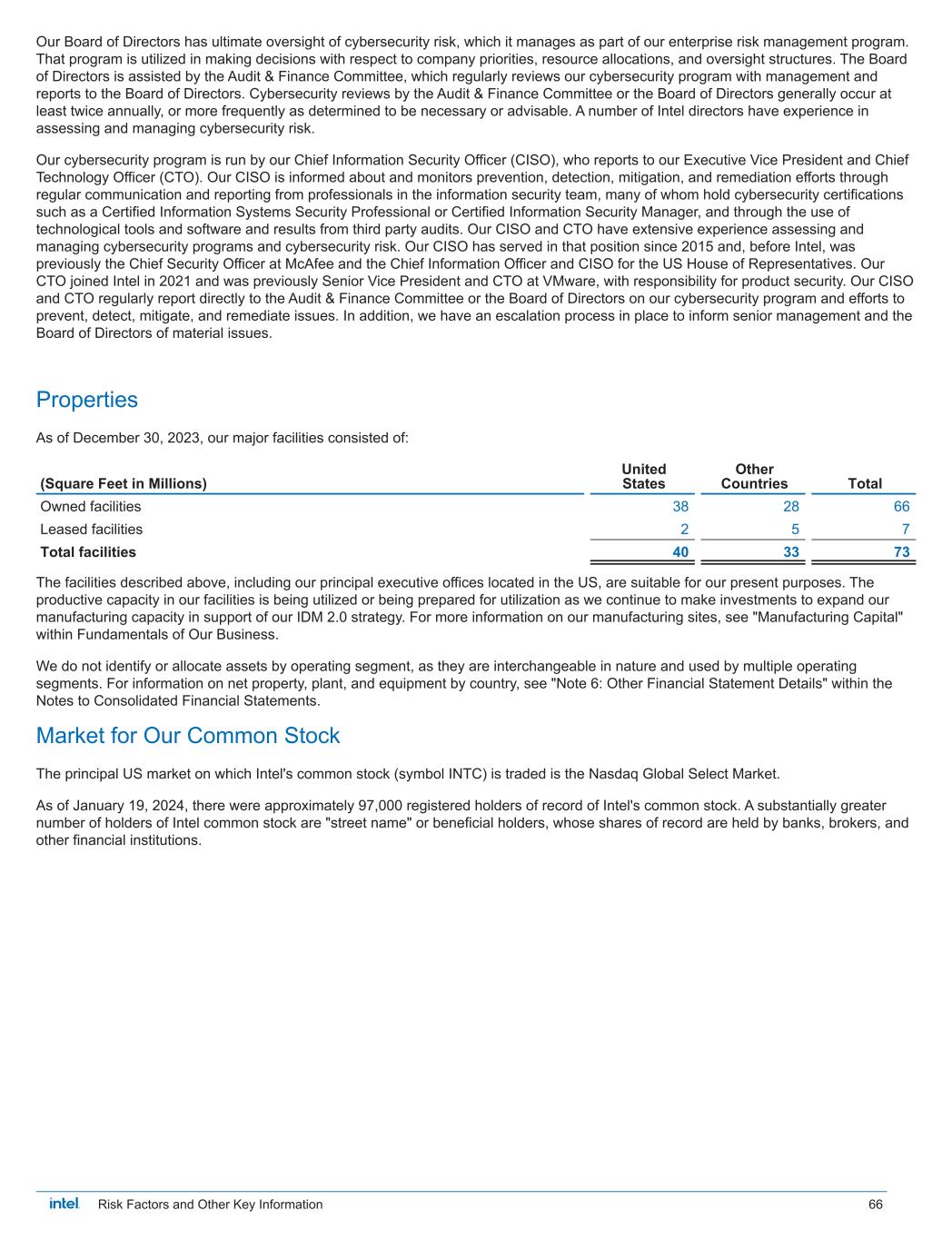

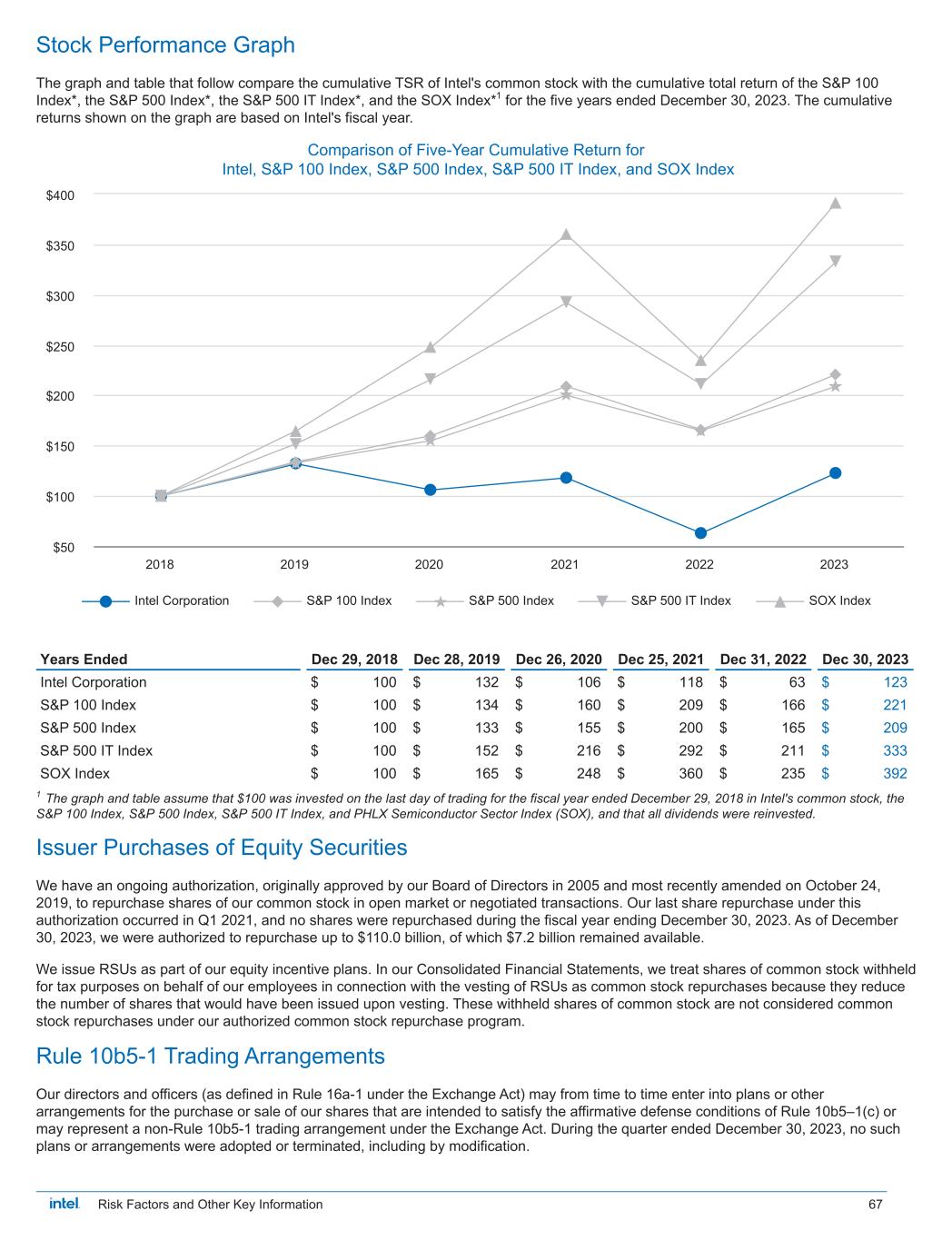

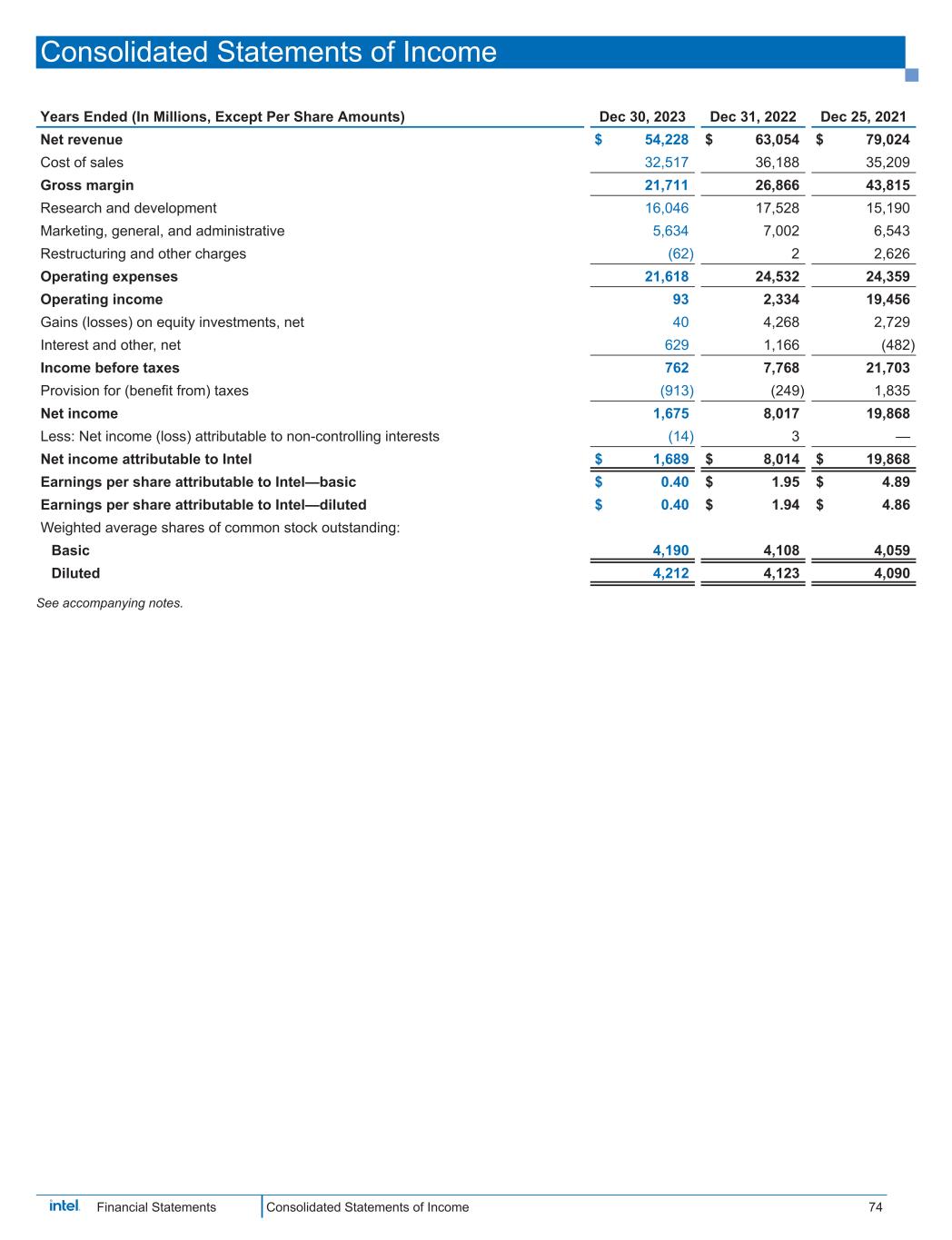

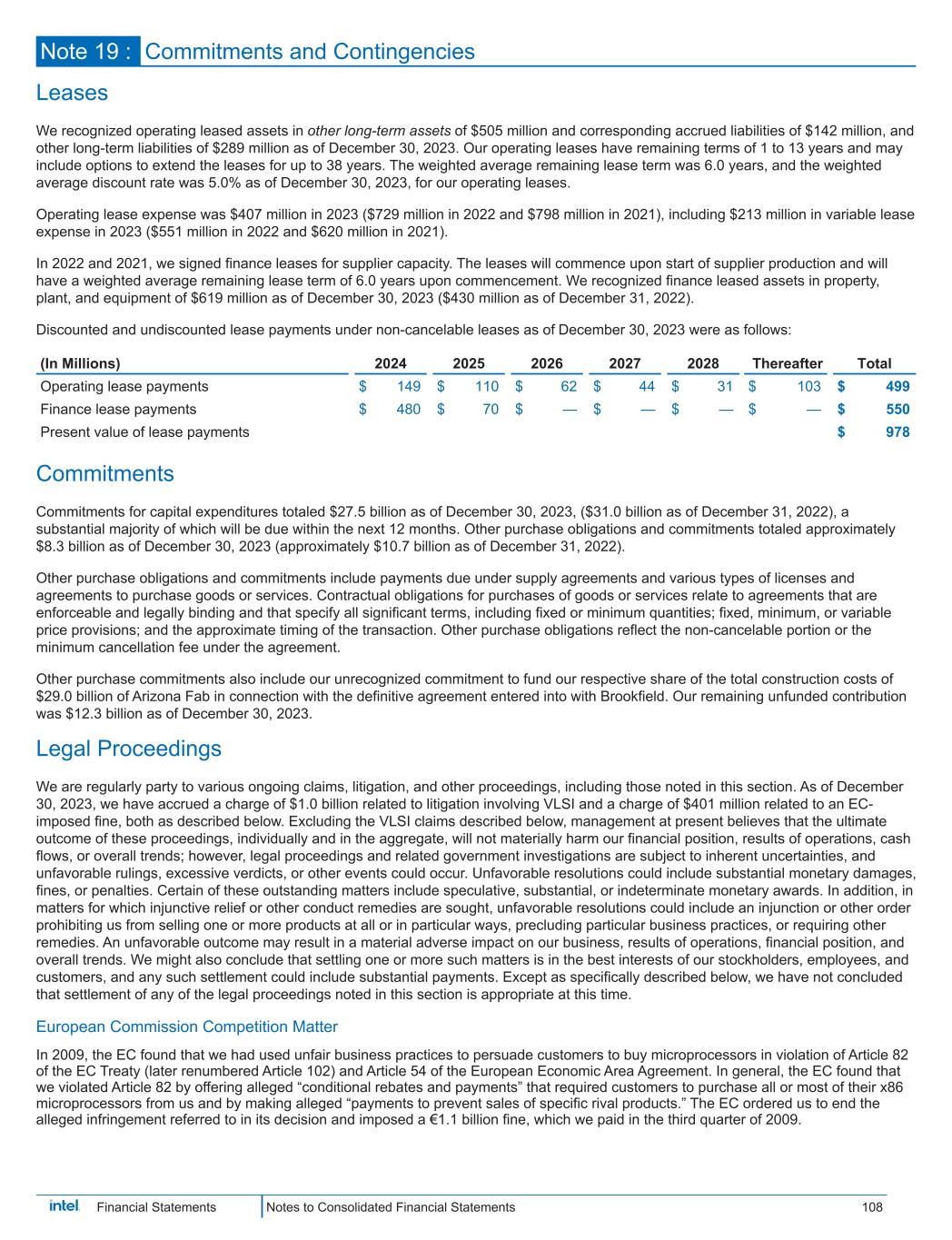

Revenue Gross Margin Diluted EPS Attributable to Intel 2022 2023 $63.1 2022 $54.2 2023 47.3% 43.6% $(11.9) 2023 $1.67 $1.05 $0.40 $(4.1) 2022 2023 2022 $54.2B GAAP 40.0% GAAP 43.6% non-GAAP1 $0.40 $1.05 GAAP non-GAAP1 $11.5B $(11.9)B GAAP non-GAAP1 A Year in Review 2023 revenue was $54.2 billion, down $8.8 billion, or 14%, from 2022. CCG revenue decreased 8% due to lower notebook and desktop volume from lower demand across market segments, partially offset by increased volume in the second half of the year as customer inventory levels normalized compared to higher levels in the first half. Notebook ASPs decreased due to a higher mix of small core products combined with a higher mix of older generation products. This was partially offset by higher desktop ASPs due to an increased mix of product sales to the commercial and gaming market segments. DCAI revenue decreased 20% due to lower server volume resulting from a softening CPU data center market, partially offset by higher ASPs from a lower mix of hyperscale customer-related revenue and a higher mix of high core count products. NEX revenue decreased 31% as customers tempered purchases to reduce inventories and adjust to a lower demand environment across product lines. We invested $16.0 billion in R&D, made capital investments of $25.8 billion, and had $11.5 billion in cash from operations and $(11.9) billion of adjusted free cash flow. Cash Flows ■ GAAP $B ■ GAAP ■ Non-GAAP ■ GAAP ■ Non-GAAP ■ Operating Cash Flow $B ■ Adjusted Free Cash Flow' $B Revenue down 14% from 2022 Gross margin Gross margin Diluted EPS Diluted EPS Operating Adjusted free revenue down 2.6 ppts down 3.7 ppts down $1.54 or down $0.62 or cash flow cash flow down from 2022 from 2022 79% from 37% from down $4.0B $7.8B or 191% 2022 2022 or 26% from from 2022 2022 Lower revenue in CCG, DCAI, Lower GAAP gross margin from Lower GAAP EPS from lower Lower operating cash flow and NEX. lower revenue, higher unit cost, gross margin and absence of primarily driven by lower net and higher excess capacity one-time gains recognized in income, partially offset by charges, partially offset by the 2022, partially offset by lower favorable changes in working sell-through of previously R&D and MG&A spending, and capital and other adjustments. reserved inventory, lower a higher tax benefit. inventory reserves taken in 2023, lower product ramp costs, and the absence of one-time charges recognized in 2022. Managing to our long-term financial model Our 2023 results reflect the continued advancement of our transformational journey. We continued to prioritize investments critical to our IDM 2.0 transformation, achieved operational milestones, and executed disciplined expense management. To achieve our long-term financial model, we believe it is imperative that we drive to world-class product cost and operational efficiency. A key component of our overall strategy is our internal foundry model. Under this model, we intend to reshape our operational dynamics and establish transparency and accountability through standalone profit and loss reporting for our manufacturing group in 2024. We expect this model to enable increased efficiencies across a number of aspects of our organization that we believe are integral to achieving our financial and operational goals. At the same time, we continue to prioritize capital investments critical to our efforts to regain process leadership and establish a leading-edge, at-scale foundry business. See "Non-GAAP Financial Measures" within MD&A. intel. Fundamentals of Our Business 5 #,I

PR **+IP NRK;-1

*

% R ;2

2

% I1<%

I ***

"IP NIK2<NJ

RI J KJ P

N

I

RI I KKIJK JK%IJ

L

KJ L IKP

N JK

JLIKNKJ I P J IL

P

K I

O IJ I

P

K J

IKJ

& J #$KIKNJ IM

K

I I NJK RJIM

I IJ I NJK

KRKIJ

L

KJ LIKJ #$KNJ IK M

I NJK

KJ J I

IJK JK

# IP NIK*<NJ

RIKIPIP

N IKN

J

I K

J $1J JIIJ%IJ

L

KJ LI#$K

I

RIM

LIK

NKJ II

J IP N IM

I N JI NJK

&

=IP NIK+<KNKJ IKJINIKKJ IN P J IK 8NKJJ

RI PI JI KKI NJ

K

! PKJ;3

( %J

PKJ JK

;*-

2

% ;

-

K

I IJ K ;5

76

8NKJ

IK

R

P N "I KK'I

NJ

$#JJI NJ

J J

K

RK V"##$;) V"##$V& "##$ V"##$V& "##$ VIJ K

R;) V#8NKJIK

R;) %! 7 %7 *** **+ 7!& 7& "7 & 7!& *** **+ %7 %7 %7!" %7 *** **+ %7 %7 %7

%7

*** **+ ;-1

*) 1

< 1+

3< ;

1 ;

- ;

-) ;5

76) "##$ "##$ "##$ "##$ "##$ "##$ "##$

P N R 1<

I *** IP N "I KKI R *

3JK

I *** "I KKI R +

.JK

I ***

NJ

$ R ;

-1 I .7<

I ***

NJ

$ R ;

3* I +.<

I *** IJ K

R R ;1

) I*3<

I *** #8NKJ

I K

R R ;.

2) I7<

I *** 0 RIIP N "% # % &

=

0 RI"##$I KKI

I

RIIP N%IN J KJ% IMKKJL IK%IJ

L

KJ LJ K

JI N

IP NK

L IKIP P J IL%

RI P J ILIKIPKJ **+%

RII NJI KJK% J K

J IKI O ***

0 RI"##$

$

I

RI I KKI K

J KI O ***%IJ

L

KJ L

RI

( '"(#K % IJM

J

0 RI IJ K

R II

LIP L

RI J %IJ

L

KJ L

P I

K R I J

JI8NKJ JK

' J NI

JI

NI**+IKN

JKI

JJ J NP J

NIJI K

IJ

8 NI L

! J NJ I IJO PKJ JKIJ

J NI '*

JI K

IJ %P IJ

KJ K% MNJK

M K J

P NI

JI

%R

PJKIJPJJRIPJ R I

KKI NJ KJ IJ

L

#L J

NI PI

KJIJLK NI JI

N IL

1 IJK

%R J J IK NI IJ

L K KJ

K JI KI L N J

JLJI NKJ

I

J

KKI IJ

I NI N

JNI I N **1

!MJJK

J

IK

KI KK N I

KJK

NI I OJ JJR

PI JI

J P NI

IJ

K

#JJKJ%R J NJ I IJOJ

PKJ JKIJ

J NI

IJKJ I I KK

IK KJ

K

%JK

N IL NK KK

* /&

0;-#

$

"#$ 7 $61! 6B#

2#

7 N J

K

NI)NK KK -

Delivering leadership products We seek to develop and offer leading products that will help enable a future in which every human can have more computing power and quicker access to data. We remain committed to our goal of delivering five technology nodes in four years to regain transistor performance and power performance leadership by 2025. This year, we achieved several key milestones on our product roadmap, including: • We launched the Intel® Core TM Ultra processors, featuring our first integrated neural processing unit, for power-efficient Al acceleration and local inference on the PC. • We introduced the 13th Gen Intel® Core TM mobile processor family, led by the launch of the first 24-core processor for laptops, and introduced the new Intel vPro® Platform powered by the full lineup of 13th Gen Intel Core processors. We introduced the 14th Gen Intel® Core TM desktop processor family, delivering fast desktop frequencies and enhanced desktop experience for enthusiasts. • We launched the 4th Gen Intel® Xeon® Scalable processors, a critical part of our heterogeneous hardware and software portfolio to accelerate real-world data center, cloud and edge workloads, including Al, and also launched the 4th Gen Intel Xeon Scalable processors with Intel® vRAN Boost, a new general-purpose chip that fully integrates Layer 1 acceleration into the Xeon SoC and is designed to eliminate the need for external accelerator cards. • We launched the 5th Gen Intel® Xeon® Scalable processors for data center, cloud, and edge, with embedded capabilities for powering Al workloads. • We introduced two new Intel® Arc1M Pro Graphics Processing Units, Intel Arc Pro A60 and Intel Pro A60M, and shipped Intel Arc Pro A40-based systems. Investing in leading-edge, at-scale manufacturing We are committed to strengthening the resilience of the global semiconductor supply chain for leading-edge semiconductor products by investing in geographically balanced manufacturing capacity. In the US, we are expanding our existing operations in Arizona, New Mexico, and Oregon, and investing in two new leading-edge chip factories in Ohio. We have submitted all four of our major project proposals in Arizona, New Mexico, Ohio, and Oregon, estimated to represent over $100 billion of US manufacturing and research investments over the next five years, to the US Department of Commerce's CHIPS Program Office. In the European Union and Israel, we have announced a series of investments, spanning our existing operations in Ireland and Israel, as well as our planned investment of more than $33 billion in Germany to build a leading-edge wafer fabrication mega-site, and our plans to invest up to $4.6 billion in an assembly and test facility in Poland. We also announced the start of high-volume manufacturing using Intel 4 technology and EUV technology in Ireland. Unlocking value We continue to look for innovative ways to unlock value for our stakeholders. We sold a 32.4% minority stake in our IMS Nanofabrication business, including investments from Bain Capital and Taiwan Semiconductor Manufacturing Company (TSMC). Net proceeds resulting from the IMS minority stake sales totaled $1.4 billion. We also executed a secondary offering of Mobileye stock that generated net proceeds of $1.6 billion. Further, we communicated our intent to operate our Programmable Solutions Group (PSG) as a standalone business, with standalone financial reporting beginning January 1, 2024. This is expected to enable potential private and public equity investments. These transactions provide an additional source of capital to support the critical investments needed to advance our strategy. intel. Fundamentals of Our Business 6

PI

IKI NJK !KJ P

I

I NJKJJR

NJNI RPILN P I NJ RI QNIKKJ J

!I JJJ NI

PI

PJ

L K

NILIKJ I JI KKJ I I

I RII

I

IK L**-

KLI%RPKPI

L

KJ K NII NJI %

N 9 W !

N J J

X IY1

JII KK IK%

JNI NI

IKJ JIJ NI

I KK N J%

I RI

J#

IJ

I J$

W ! JI NJ+J" J

X IY

I KK I

L%

LJ

N

J

IKJ*1 II KK I

I

J K% JI NJ R J

P$I X$

J

I RI LJ

N

N

+J" J

II KK IK

W ! JI NJ1J" J

X IYKJ I KK I

L%

PI

KJKJ

IQN K KJ MI

I JNKKJK

W !

N J1J" J

X= X

I KK IK%IJ

IJ

NIJI NKIRI K

JRI IJ

J

IJI

R I

J JI%

N R I

K%

N # %

K

N J1J" J

=

I KK IKRJ J

XP

#&) KJ% R I

NI KJJ

N

L JIJK0LI

IJ J J= KK J

JJ

IMJI

IJ IIK

W !

N J-J" J

X= X

I KK IK

IJ JI%

N% %RJ

JK

I RI # R I

K

W ! JI NJR R J

X#IY$I "IK$I KK 1 JK% J

#I$I #3 J

$I #3'% K J

#I $I #1 KKLKJK

PKJ

%JK

N

JNI !I JJJ KJI J JIK

J

K NJ IKN

L

I

K NJ II NJK L PKJ I

L

N

JNI JL

J1%RIM NIMKJ IJ K #IO %&R'M % I % PKJ JR R

J IK

!PKN JJ

NI

NI8 II 8JI K

K #IO %&R'M % % I %KJJJ IIK J PI;

1 N

JNI IKI PKJ JK PIJ MJ

PLIK%J J1 IJ J

I/K> $$I I

J

NI 1 KI

%RP N KIK

PKJ JK%K NIMKJ IJ K I

KI

%K R

K NI

PKJ J

IJ ;++

"I LJ N

R

I

IJ KJ% NI

KJ PKJNJ ;1

3

KK

L JKJ

JL $

!

K N JKJIJ

P

N N

JNI NK J

1 J

L

1?J

L I

1

P

N ! J NJ

I PJPRLKJ N

P

N

I NIKJ

IK

!K

+*

1< IJLKJ NI '&

IJ NK KK%

N PKJ JK

I ) J

R NJ I' N

JNI L5'6

&JI KIKN

J

I J ' IJLKJK

KJ J

;

1

!

K MNJK IL

I

'

LKJ JJ IJ J I K

;

3

NIJI%R N J NI J JJ IJ NI$I I

NJ K"I N5$"6KKJ

NK KK%RJKJ

I IJ @ NIL%**1

KKMJJ

J J

IPJ N

QNJL PKJ JK

KJI KJ KI P J

K NI

J

J KN IJJIJ

PKJ JK J P NIKJIJL

N J

K

NI)NK KK 3

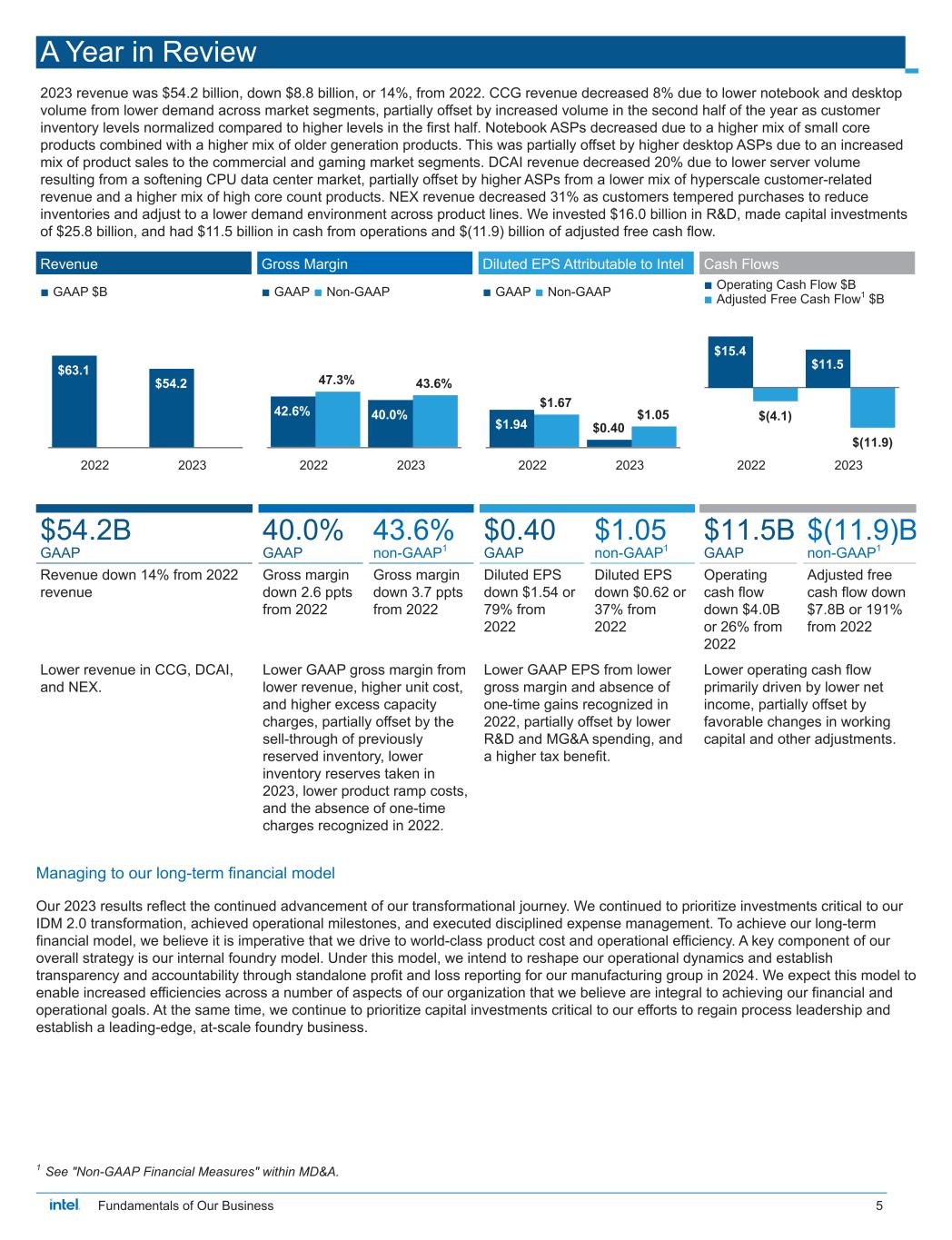

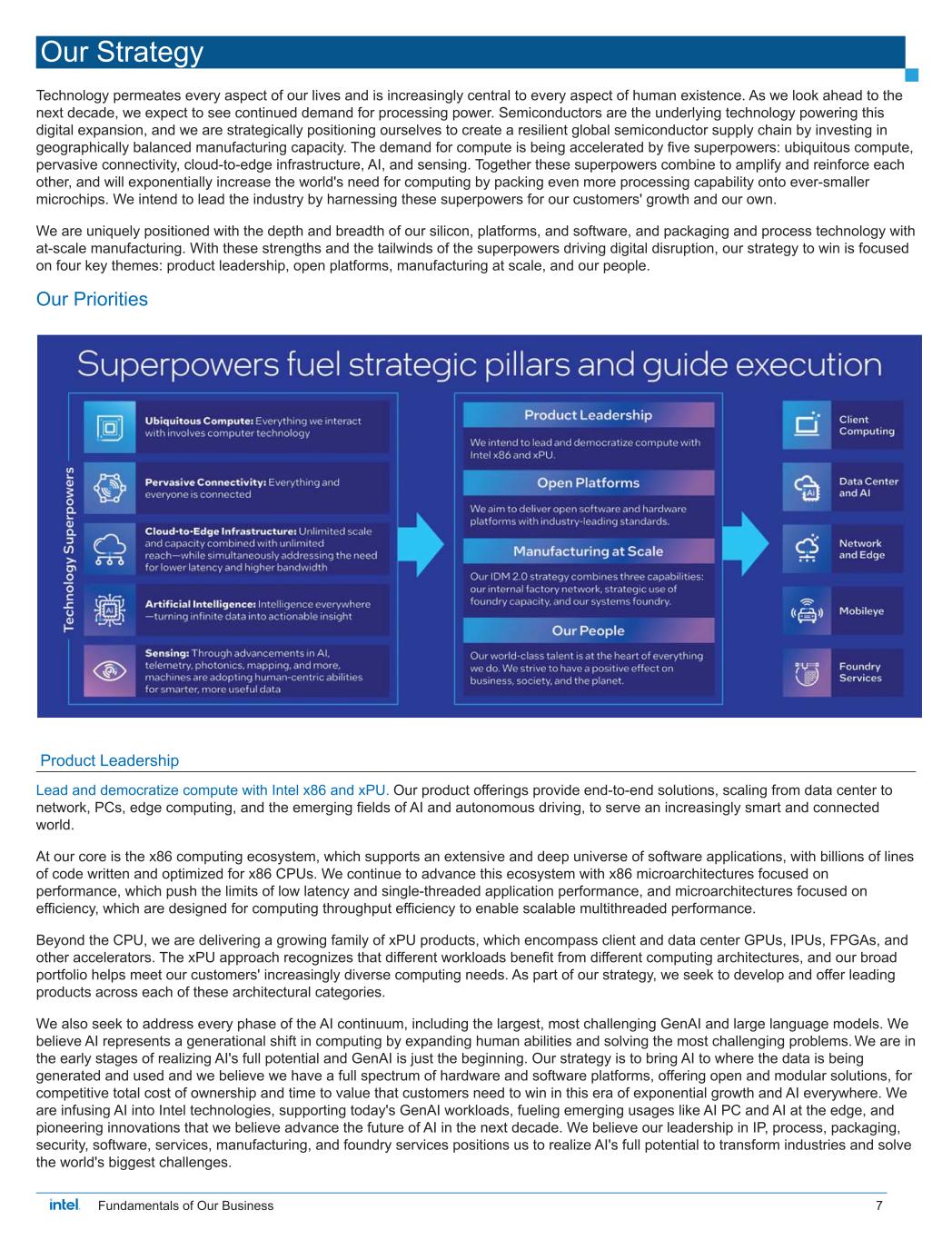

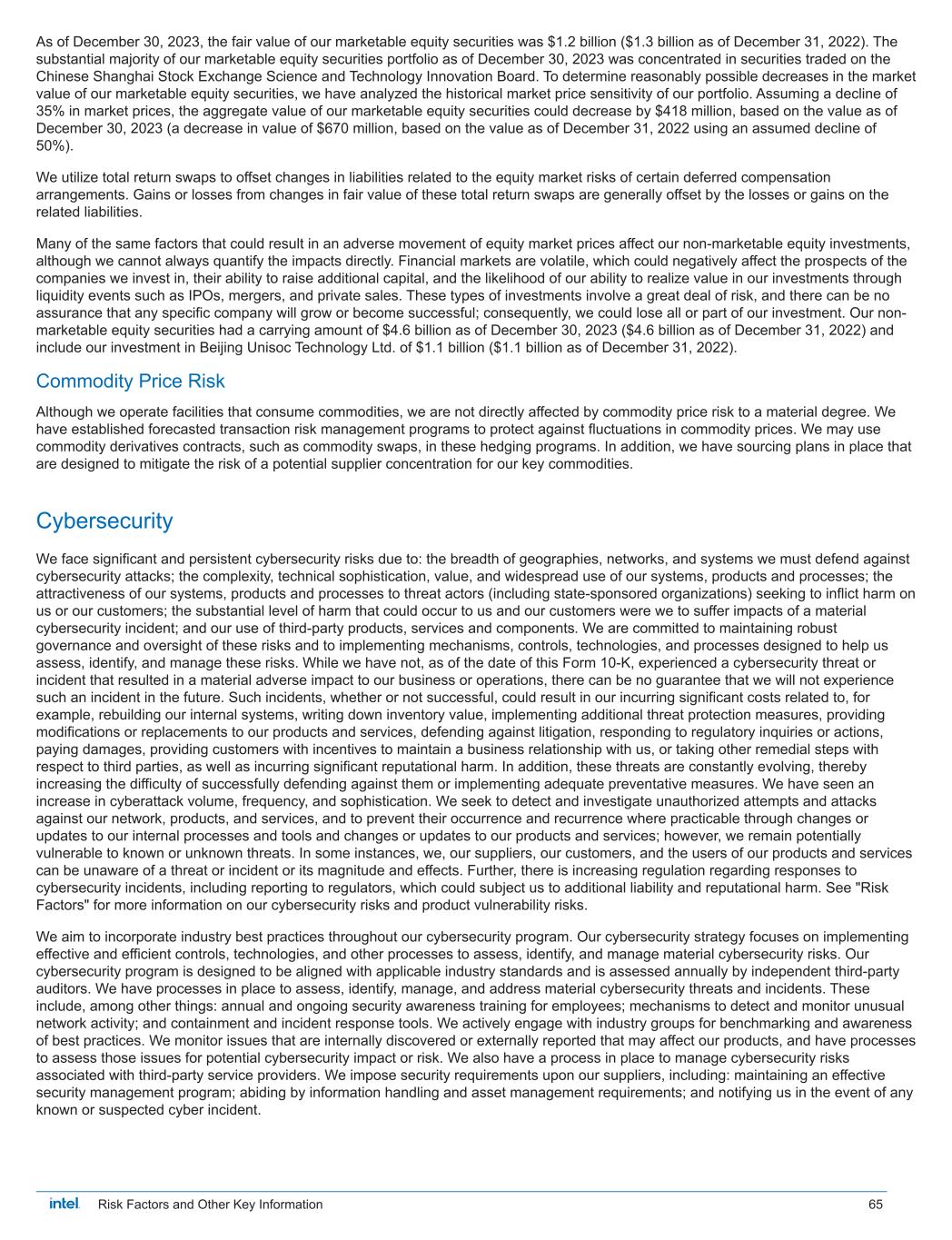

Superpowers fuel strategic pillars and guide execution Ubiquitous Compute:Everything we interact with involves computer technology CS ec no o u •e r• ow er Eit aroduct Leadership We intend to lead and democratize compute with Intel x86 and 111P1atforms We aim to deliver open software and hardware platforms with industry-leading standards. Manufacturing at Scale Our I M 2.0 strategy combines three capabilities: our internal factory network, strategic use of foundry capacity. and our systems foundry. Our People Our world-class talent is at the heart of everything we do. We strive to have a positive effect on business, society, and the planet. Network and Edge 6)26 Mobileye Pervasive Connectivity: Everything and everyone is connected Cloud-to-Edge Infrastructure: Unlimited scare and capacity combined with unlimited reach—while simultaneously addressing the need for lower latency and higher bandwidth Artificial Intelligence: Intelligence everywhere —turning infinite data into actionable insight Sensing: Through advancements in Al, telemetry, photonics, mapping, and more, machines are adopting human-centric abilities for smarter, more useful data Our State. Technology permeates every aspect of our lives and is increasingly central to every aspect of human existence. As we look ahead to the next decade, we expect to see continued demand for processing power. Semiconductors are the underlying technology powering this digital expansion, and we are strategically positioning ourselves to create a resilient global semiconductor supply chain by investing in geographically balanced manufacturing capacity. The demand for compute is being accelerated by five superpowers: ubiquitous compute, pervasive connectivity, cloud-to-edge infrastructure, AI, and sensing. Together these superpowers combine to amplify and reinforce each other, and will exponentially increase the world's need for computing by packing even more processing capability onto ever-smaller microchips. We intend to lead the industry by harnessing these superpowers for our customers' growth and our own. We are uniquely positioned with the depth and breadth of our silicon, platforms, and software, and packaging and process technology with at-scale manufacturing. With these strengths and the tailwinds of the superpowers driving digital disruption, our strategy to win is focused on four key themes: product leadership, open platforms, manufacturing at scale, and our people. Our Priorities Product Leadership Lead and democratize compute with Intel x86 and xPU. Our product offerings provide end-to-end solutions, scaling from data center to network, PCs, edge computing, and the emerging fields of Al and autonomous driving, to serve an increasingly smart and connected world. At our core is the x86 computing ecosystem, which supports an extensive and deep universe of software applications, with billions of lines of code written and optimized for x86 CPUs. We continue to advance this ecosystem with x86 microarchitectures focused on performance, which push the limits of low latency and single-threaded application performance, and microarchitectures focused on efficiency, which are designed for computing throughput efficiency to enable scalable multithreaded performance. Beyond the CPU, we are delivering a growing family of xPU products, which encompass client and data center GPUs, IPUs, FPGAs, and other accelerators. The xPU approach recognizes that different workloads benefit from different computing architectures, and our broad portfolio helps meet our customers' increasingly diverse computing needs. As part of our strategy, we seek to develop and offer leading products across each of these architectural categories. We also seek to address every phase of the Al continuum, including the largest, most challenging GenAl and large language models. We believe Al represents a generational shift in computing by expanding human abilities and solving the most challenging problems. We are in the early stages of realizing Al's full potential and GenAl is just the beginning. Our strategy is to bring Al to where the data is being generated and used and we believe we have a full spectrum of hardware and software platforms, offering open and modular solutions, for competitive total cost of ownership and time to value that customers need to win in this era of exponential growth and Al everywhere. We are infusing Al into Intel technologies, supporting today's GenAl workloads, fueling emerging usages like Al PC and Al at the edge, and pioneering innovations that we believe advance the future of Al in the next decade. We believe our leadership in IP, process, packaging, security, software, services, manufacturing, and foundry services positions us to realize Al's full potential to transform industries and solve the world's biggest challenges. Intel. Fundamentals of Our Business 7 NIJIJL

LIJKPILKJ

NI

PK K IK

L JI

J PILKJ

N MKJ

#KR

J J MJ%RMJJ K J N

II KK RI

NJ IKIJN I

L J

L RI JK J

M K % RIKJIJ

L KJ NIK

PKJ IJIK

J

K NJ IKN

L L PKJ I

L

N

JNI JL

I NJK

IJ L

PKNI RIK9N QNJ NK NJ% IPKP JPJL%

NJ

IKJINJNI%# % K K

JIJKKNI RIK J

L I

I JI% R

M J

L IKJR I

/K

I NJ L P II KK

JL J PIK

I I K

! J J

J NKJIL LI KK JKKNI RIK

I NINKJ IK/I RJ NI R

!IN QN

L KJ RJJJ IJ

NIK

%

J

IK% K

JRI% I KKJ

LRJ JK

N

JNI

!JJKKJI JK JJ

R K

JKNI RIKIP J

KINJ % NIKJIJLJ R K

NK

NILJK9I NJ

IK%

J

IK% N

JNI JK

% NI

NI$I IJK $I NJ0IK 0 IJO NJRJ J

M23 M$1

NII NJ

I KI P J K

NJ K%K

I J JIJ JR I%$K% NJ % JI

K

# NJ NKIP %J KIP IK

LKIJ J R I

#J NI IKJM23 NJ KLKJ%RKN IJK MJ KP N PIK

K

JRI

J K%RJ

K

K

RIJJ JO

IM23$1K

! J NJ P JK KLKJRJM23I IJJNIK

NK I

I %RNKJ

JK

R

J L K

JI

J I

I % I IJJNIK

NK

L%RIK

I NJ JI NNJ

LJ

K

N

JJII

I

)L J$1%RI

PI I R

L

M$1I NJK%R KK

J J JI"$1K% $1K%$"#K% JI

IJ IK

M$1I I OKJJ

I JR I

K

J

I

I J NJ IJJNIK% NI I IJ

KJ NINKJ IK/ IK

LPIK NJ K

#KIJ

NIKJIJL%RKJ P

I

I NJKI KK

JKIJJNI

J IK

!

K KJ IKKPILK

J# J NN%

N J

IKJ% KJ

" #

I

N

K

!

P# IIK JK IJ

K

J NJ LM N

JK K

P J KJ

I

K

!I JI

LKJK

I

O # /K

N

J J

" # K8NKJJ

NIKJIJLKJ I # J RIJJK IJ NK R

PRP

N

KJIN

IRI K

JRI

J

IK%

I N

IK

NJ K%

I JJPJ J

KJ

R IK JJ P

NJJNKJ IK J R JKI

M J

I RJ # PILRI

! I

NK # J J

J

K%KN IJ J L/K" # R I

K%

N

I NKK

# $ # JJ% I PJ KJJR

PP J

NJNI

# J MJ

!

P NI

IK $%I KK% % KNIJL%K

JRI%KIPK% N

JNI %

N ILKIPK KJ KNKJ I

O# /K

N

J J

J JI K

I NKJIK K

P JR I

/K KJ

K

N J

K

NI)NK KK .

Open Platforms We aim to deliver open software and hardware platforms with industry-defining standards. Around the globe, companies are building their networks, systems, and solutions on open standards-based platforms. Intel has helped set the stage for this movement, with our historic contributions in developing standards such as CXL, Thunderbolt1M, and PCI Express*. We also contributed to the design, build, and validation of open-source products in the industry such as Linux*, Android*, and others. The world's developers constantly innovate and expand the capabilities of these open platforms while increasing their stability, reliability, and security. In addition, microservices have enabled the development of flexible, loosely coupled services that are connected via application programming interfaces to create end-to- end processes. We use industry collaboration, co-engineering, and open-source contributions to accelerate software innovation. Through our oneAPI initiative, developers use a unified language across CPUs, GPUs, and FPGAs that is designed to reduce development time and to enhance productivity. We also deliver a steady stream of open-source code and optimizations that are designed for projects across virtually every platform and usage model. We are committed to co-engineering and jointly designing, building, and validating new products with software industry leaders to accelerate mutual technology advancements and help new software and hardware work better together. Our commitment extends to developers through our developer-first approach based on openness, choice, and trust. Ultimately, we believe our pivot to a software-defined, silicon-enhanced strategy will enable us to realize value at all layers of the compute stack. This should allow us to continue to monetize foundational and ecosystem-enabling software through hardware sales, limited licensing, and customer-enabling service offerings. Additionally, we are expanding our software portfolio by developing and monetizing software solutions, services, and platforms with SaaS, software subscriptions, and other business models. We are prioritizing three portfolios of offerings for our SaaS and subscription-based software: AI, trust and security, and performance optimization. We are also scaling the availability of Intel® Developer Cloud, which is designed to enable developers to learn, prototype, test, and run their own Al workloads across multiple Intel hardware architectures to experience the competitive performance of Intel platforms and develop their Al software from today's hardware portfolio to next-generation architectures. An open approach and deep engagement with the developer ecosystem are essential to lowering barriers to entry and unlocking Al innovations for developers and customers. We are expediting an open Al software ecosystem that we believe is needed to break down proprietary walls. We offer customers, partners, and developers early access and a rapid path to scale their Al solutions with the Intel Developer Cloud and integrated and scalable hardware and software systems and solutions. We believe Al will only be truly accessible to all when its use is ethical and responsible. Partnering with industry leaders, we are working to deliver innovative ecosystem tools and solutions intended to make Al safer and more secure, and help address privacy concerns as Al scales exponentially. We are building platforms and technologies for the convergence of Al and security to help customers confidently secure diverse Al workloads across the data center, cloud, PC, and edge. Manufacturing at Scale IDM 2.0, the next evolution and expansion of our IDM model, is a differentiated strategy that combines three capabilities: Internal factory network. Our global, internal factory network has been foundational to our success, enabling product optimization, improved economics, and supply resilience. We intend to remain a leading developer of process technology and a major manufacturer of semiconductors and will continue to build the majority of our products in our factories. Strategic use of foundry capacity. We expect to expand our use of third-party foundry manufacturing capacity, which will provide us with increased flexibility and scale to optimize our product roadmaps for cost, performance, schedule, and supply. Our use of foundry capacity will include manufacturing for a range of modular tiles on advanced process technologies. Open System Foundry. We are building a world-class foundry business to meet the growing long-term global demand for semiconductors. We plan to differentiate our foundry offerings from those of others through a combination of leading-edge packaging and process technology, committed capacity in the US and Europe available for customers globally, and a world-class IP portfolio that will include x86 cores, as well as other ecosystem IP. The current foundry model enabled explosion of ecosystem innovation at the wafer level. We believe this established model has historically served the industry well, but a new mindset is needed in our new era of chipmaking. As innovation evolves, we see the rack has collapsed into a system and the system has collapsed into an advanced package. We are building out an Open System Foundry that has four components: wafer fabrication, packaging, chiplet standard, and software. The Open System Foundry involves engaging with customers at multiple levels, from basic wafer manufacturing to helping define and implement their desired system architectures. We intend to build our customers' silicon designs and deliver full end-to-end customizable products built with our advanced packaging technology. We believe our IDM 2.0 strategy enables us to deliver leading process technology and products to meet growing long-term demand using internal and external capacity, while leveraging our core strengths to provide foundry services to others and providing superior capacity, supply resilience, and an advantageous cost structure. In the upcoming year, we plan to implement an internal foundry model, where our business units engage with our manufacturing group in an arm's-length fashion, similar to how fabless semiconductor companies engage with external foundries. The model is integral to our IDM 2.0 operational and financial strategies and aims to fully leverage our invested capital while serving a wide variety of chip customers worldwide. intel. Fundamentals of Our Business 8 $

J

IK !J

PI K

JRI IRI

J

IKRJ NKJIL

KJ IK

#I N J

% KI N

JI JR IK%KLKJK% K

NJ K KJ IK K

J

IK

J

K

KJJKJ

IJK P J%RJ NIKJ I JI NJ K P

KJ IKKNK=0%N I

JY% $

MIKKA

!

K JI NJJ JK % N

% P

J

K NII NJK J NKJILKNK0 NMA%# I A% JIK

R I

/KP

IK KJ J

L PJ M J

JK

JK

J

IKR

IK JIKJ

JL%I

JL% KNIJL

J %I KIPKP

JP

J

M

%

K

L N

KIPKJJI JP

J I I JI

KJ IJ J I KKK

!NK NKJIL

IJ % I % K NI JI NJ KJ

IJK

JRI PJ

I N NI #$ JJP%P

IKNKN

NI KK$1K%"$1K% $"#KJJKK J INP

JJ J I NJPJL

!

K

PIKJLKJI

K NI JOJ KJJIK

II 8JKI KK PIJN

LPIL

J

I NK

!I JJJ I 8 J

LK % N

% P

J RI NJK RJK

JRI NKJIL

IKJ

IJNJN

J

LP JK

RK

JRI IRIR I JJIJ JI

NI J JMJ KJ P

IKJI N NIP

I

IKJI K KK% % JINKJ

1

JJ

L%R

P NIP JJ K

JRI

%K

KJIJLR

NKJ I

OP

NJ

LIK

J NJ KJ

KK N

RNKJ J NJ JO

N J

KLKJ

K

JRIJI NIRIK

K%

J

K % NKJ I

KIP

I K

#J

L%RIM NIK

JRI IJ

LP

JO K

JRIK

NJ K%KIPK%

J

IKRJ%K

JRIKN KIJ K% JI NK KK

K

!II IJO JI IJ

K

I K

I NI KN KIJ KK

JRI9# %JINKJ KNIJL% I

I JOJ

!I

K K

JP

JL

J

X P

I

N%RKK J

P

IKJ

I %I J JL%JKJ% IN JI R # R I

KI KKN

J

J

IRIIJJNIKJ MI J JJPI

I

J

J

IK P

JI# K

JRI

I J LTKIRI IJ

J MJ IJ IJJNIK

# I JRJJP

I KLKJIKK J

J

RI IIIKJ JIL N

# PJ K

IP

IK NKJ IK

!IMJ # K

JRI KLKJJJR

PK J I R I IJILR

K

!

INKJ IK%IJ IK% P

IKI

LKK IJJ K

JI# K

NJ KRJJ J

P

I

N JIJ K

IRI K

JRIKLKJK K

NJ K

!

P# R

L JIN

LKK

J

R JKNKKJ

IK K

$IJ I RJ NKJIL

IK%RIR I J

PI PJP KLKJJ

K K

NJ K J J # K

I IKNI%

IKKIPL I KK# K

KM J

L

!I N

J

IK J

K

IJ PI

# KNIJLJ

NKJ IK

J

L KNIPIK# R I

KI KKJJ JI%

N%$%

' N

JNI J

'*

%J MJP

NJ M K

NI '

%K

I JJKJIJLJJ KJI

JK9 JI

J IL JR I

NI

% JI

J IL JR IK

N J

J NIKNKK%

I NJ JOJ % I P K% KN

LIK

! J J I

P

I

I KKJ

L 8 I N

JNII

K NJ IK R

J NJ N

J8 IJL

NII NJK NI

J IK

JIJNK

N ILJL

!MJJ M NINK

JIIJL

N IL N

JNI JL%RR

I PNKRJ IK

M

JL K

J JO NII NJI K

I KJ%I

I %KN

% KN

L

NINK

N ILJL R

N N

JNI

II

N

IJ

K P I KKJ

K

LKJ N IL

!I N

R I

KK

N IL NK KKJ JJI R

JI

IK NJ IK

!

J

I JJ NI

N IL

I K

I J K

JIKJI N J

I KK J

L% JJJL J1

NI P

INKJ IK

L% R I

KK $ IJ

JJR

NM23 IK%KR

K JI KLKJ $

NII J

N IL

M

K

KLKJ PJ JJR

I

P

!

P JKKJ

K

KKJ I

LKIPJ NKJILR

% NJ R KJK NI RI

#K PJ P

PK%RKJIK

K J KLKJ JKLKJK

K J P

!I N

NJ LKJ N ILJJK

NI JK9R

I

IJ % %

JKJ I% K

JRI

LKJ N IL P

PK RJNKJ IKJN

J

P

K%

I KR

I N

JNI J

JJIKIKLKJIJJNIK

! J J N

NINKJ IK/K

K K

PI

N

J NKJ O

I NJK N

JRJ NIP J

L

!

P NI '*

KJIJL

KNKJ

PI

I KKJ

L I NJKJ JI R

JI NK JI

MJI

JL%R

PI NI IKJI JKJ I P

N ILKIPKJ JIK I P KNI IJL% KN

LIK

% P J NK KJKJINJNI

JN LI%R

J

J JI

N IL

%RI NI NK KKN JK RJ NI N

JNI I N I/K

J

K %K

IJ R

KKK NJ I K RJMJI

N IK

K JI

J NI ' *

IJ

KJIJK KJ

N

L

PI NI PKJJ

R

KIP RPIJL

NKJ IK R I

R

N J

K

NI)NK KK 2

Recent events, including the pandemic-related global chip shortage, made clear how supply chain disruptions can severely impact everyday life. The steady rise of chipmaking capacity in Asia has made the world vulnerable to continued and increasingly extreme shortages. We believe a secure, balanced, and resilient supply of semiconductors is essential to the interests of the entire global economy. With one of the most geographically balanced supply chains across North America, Europe and Asia, we plan to partner with the public sector to strengthen the resilience of the global semiconductor supply chain by investing in a more geographically balanced capacity. We believe our investments will help develop a more resilient supply chain for generations to come and hedge against geopolitical instability. Our People Our world-class talent is at the heart of everything we do. Together we strive to have a positive effect on business, society, and the planet. Delivering on our strategy and growth ambitions requires attracting, developing, and retaining top talent from across the world. Our people build our technology, unlock new business opportunities, and work with our partners and customers to create global impact. Fostering a culture of empowerment, inclusion, and accountability is also core to our strategy. We are committed to creating an inclusive workplace where the world's best engineers and technologists can fulfill their dreams and create technology that improves the life of every person on the planet. Growth Imperative We are investing to position the company for accelerated long-term growth, focusing on both our core businesses and our growth businesses. In our client and server businesses, our strategy is to invest to strengthen the competitiveness of our product roadmap and to explore new opportunities. We believe we have significant opportunities to grow and gain share in graphics; mobility, including autonomous driving; networking and edge; AI; software; and foundry services. Focus on Innovation and Execution We are focused on executing our product and process roadmap and accelerating our cadence of innovation. We have set a detailed process and packaging technology roadmap and announced key architectural innovations to further our goal of delivering leadership products in every area in which we compete. We are returning our culture to its roots in innovation and execution, drawing on principles established by our former CEO Andy Grove that emphasize discipline and accountability. This includes using OKRs throughout the organization to drive a common purpose. To help us execute toward our IDM 2.0 strategy, we are leveraging our Smart Capital approach. This approach is designed to enable us to adjust quickly to opportunities in the market, while managing our margin structure and capital spending. The key elements of Smart Capital include: ■ Smart capacity investments. We are aggressively building out manufacturing shell space, which gives us flexibility in how and when we bring additional capacity online based on milestone triggers such as product readiness, market conditions, and customer commitments. ■ Government incentives. We are continuing to work with governments in the US and Europe to advance and benefit from incentives for domestic manufacturing capacity for leading-edge semiconductors. ■ SCIP. We are accessing strategically aligned capital to increase our flexibility and help efficiently accelerate and scale manufacturing build-outs. This type of co-investment also demonstrates how private capital is unlocked and becomes a force multiplier for government incentives for semiconductor manufacturing expansion. ■ Customer commitments. IFS is working closely with potential customers to make advance payments to secure capacity. This provides us with the advantage of committed volume, de-risking investments while providing capacity corridors for our foundry customers. ■ External foundries. We intend to continue our use of external foundries where their unique capabilities support our leadership products. intel. Fundamentals of Our Business 9

JP JK%

N J I

J

K IJ%

I RKN

L KINJ K KPI

LJ PILL

KJLIK

JL #KKJR I

PN

I

J J N IK

LMJI K IJK

!

PKNI%

% IK

JKN

L

K NJ IKKKK J

J J JIKJK

J JI

L

!J

J KJ I

L

KN

L KI KK& IJ#I%

NI #K%R

J IJ IRJ JN

KJ IJ KJI J JIK

J

K NJ IKN

L L PKJ I I

L

JL

!

P NI PKJ JKR

P

IIK

JKN

L

I IJ KJ KJ

J

KJ

JL

NI$

NIR I

KKJ

JKJJIJ

PILJ R

JIRKJIPJ P KJP

J NK KK%K JL% J

J

PI NIKJIJL I RJ J KIQNIKJJIJ %P

% IJ J J

J

I I KKJR I

NI

N

NIJ

L%N

R NK KK IJN JK% R IRJ NIIJ IK NKJ IKJ IJ

J

KJI N

JNI

RI J%

NK % N J

JLK

K IJ NIKJIJL

!I JJJ IJ

NKP R I

RIJR I

TK KJ IK J

KJK

N

JIIK IJJ

LJJI PKJ

PIL IK J

J

"I RJ IJP !I PKJ J KJ J L

I

IJ

JII RJ%

NK J NI I NK KKK NII RJ NK KKK

NI

J KIPI NK KKK% NIKJIJLKJ PKJJ KJI J J JJP KK

NII NJI J M

I R IJN JK

!

PRPK

J IJN JKJ I R KI IK:

JL%

N NJ NKIP : JR I :# :K

JRI:

N ILKIPK

NK PJ

MNJ !I

NK MNJ NII NJ I KKI

IJ NI

PJ

!PKJJ

I KK J

LI N LIJJNI

PJ KJ

NIJI NI

PI

IK I NJK PILI RR J

!IIJNI NIN

JNIJ JKI JK PJ MNJ %IR I

K KJ

K L NI

II

# L"I PJJKOK

N J

JL

K

NKNK

KJI N NJJ I OJ J IP NI K

NKMNJJ RI NI '*

KJIJL%RI

PI NIIJJ

I

KI KK J

NKJ 8NKJQN

LJ IJN JK JIJ%R

NII KJINJNI J

K

L

JK

IJ J

N9 G IJJL PKJ JK

!IIKKP

L N

NJ N

JNI K

K%RPKNK

M

JL R R R I J

JL

K

KJ JIIKKNKI NJI KK%IJ J K% NKJ I J JK

G " PI J JPK

!I J N J R IRJ PI JK J1

NI J P

J

I JPK

I KJ N

JNI JL

I

K NJ IK

G $

!IKK KJIJ

L

J

J IK NI

M

JL

J

L

IJ K

N

JNI N

NJK

KJL

PKJ J

K KJIJK RIPJJ

KN

K

I N

J

I

I PI J JPK

IK NJ I N

JNI M K

G NKJ I J JK

KR I

K

LRJ J J

NKJ IKJ P L JKJ KNIJL

K I PKNKRJJP J

JJP

N%IK PKJ JKR

I P JL II IK

I NI

N IL NKJ IK

G

MJI

N IK

! J J J N NINK

MJI

N IKRIJIN QN

JKKN IJ NI

IK I NJK

N J

K

NI)NK KK 7